A Look at the CPI & Central Bank Response

Rents to fall, but not likely to return to pre-COIVD levels

April CPI

Inflation & It’s Components

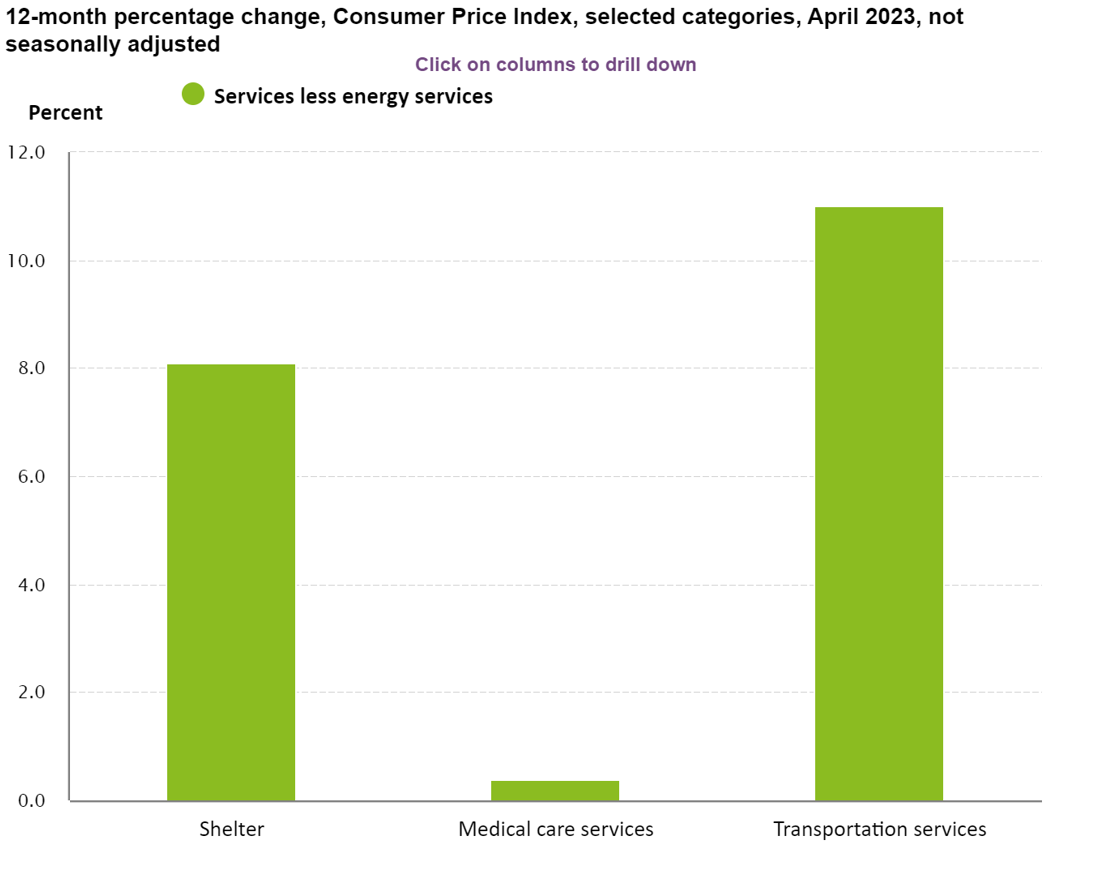

The main factors contributing to the monthly increase in the Consumer Price Index (CPI) were the Shelter index, used vehicles, and gasoline prices. Although food prices stopped rising in April, eating out became more expensive due to labor shortages. Despite Shelter usually being a slow-moving indicator, the largest jump in seven months suggests inflation won't easily return to pre-COVID levels.

Core inflation, which doesn't include food and energy costs, remains high at 5.5% year over year. This sticky inflation occurs when one category decreases while another increases. The base effect, caused by last year's CPI surge, makes year-over-year comparisons higher.

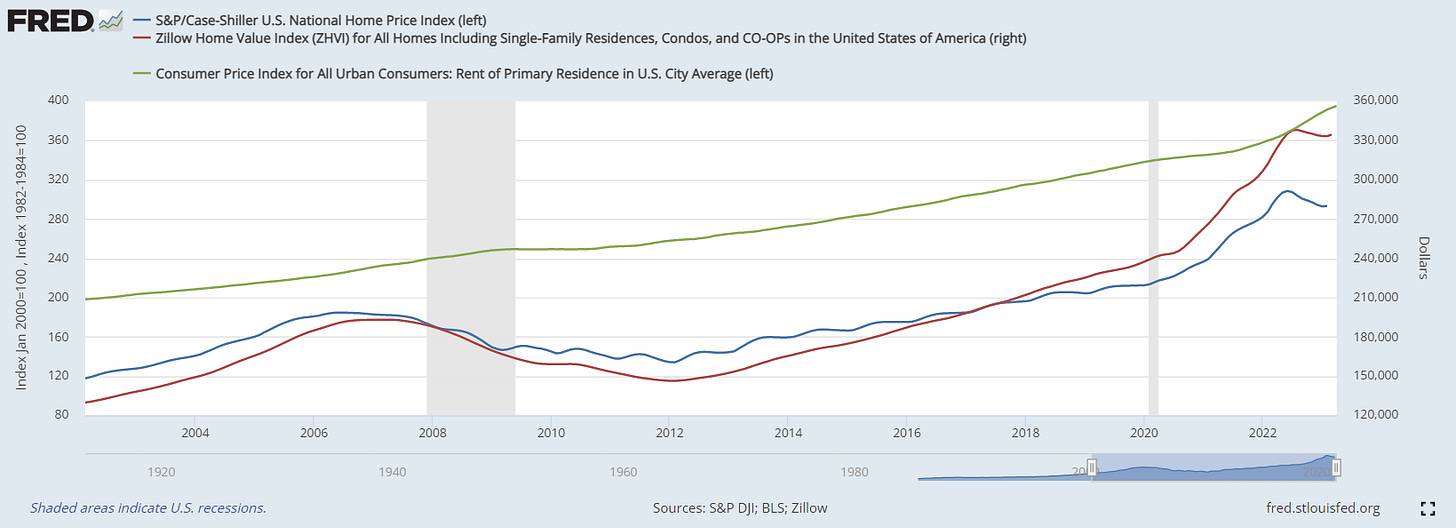

In April, services inflation (excluding energy) increased by 6.8% year over year, compared to 7.1% in March and a 40-year high of 7.3% in February. Services make up about two-thirds of consumer spending. The housing-related CPI is mainly based on rent factors like primary residence rent and owner's equivalent rent, both of which have seen significant increases in the past year.

Energy prices have played a significant role in inflation trends. Gasoline prices declined on a month-to-month basis, pushing the overall energy CPI up by 0.6% for the month. However, year-over-year, all major energy components except electricity have decreased sharply. Energy was a significant contributor to the overall CPI surge in 2021 and the first half of 2022 and is now a major factor in moderating overall CPI.

Housing Price Increases and Rent Inflation

Throughout 2022, housing price increases were a significant contributor to headline inflation, rising at the fastest pace in 40 years due to an overheated economy. Rent inflation has started to decelerate, with growth rates substantially lower than the late-2022 average for two consecutive months. The Zillow Observed Rent Index shows that the turn seen in new rental listings a year ago appears to be taking hold in CPI shelter, suggesting that the measure will fall steadily in the months to come. This decline in core services inflation has been more sustained and sharp, with annual increases in services prices excluding shelter falling from a peak of over 8% to just over 5% now. This progress in reducing the stickier components of inflation is a positive sign for the US economy.

Used Vehicle Prices and Core Inflation

A notable bump in core inflation this month resulted from a resurgence in used vehicle prices. After rising more than 50% throughout 2020 and 2021, official used car prices declined in 2022 and early 2023 as the semiconductor shortage eased and supply chains improved. However, this is likely not the end of used car inflation. While much of the wholesale price rebound has not yet passed through to retail prices and official data, used vehicle prices surged in April, contributing to an overall 0.8% increase in durable goods for the month. On the other hand, new vehicle prices have begun to decline due to increased supply and incentives from automakers.

Conflicting Interpretations of April CPI Data

The April consumer price index (CPI) data has caused disagreement among economists about the direction of core inflation. Some think the downward trend has stopped, while others see improvement. The increase in used car prices influenced April's core goods inflation, but shelter services stayed stable for two months. The drop in non-housing core services to 0.1% shows that service prices aren't surging uncontrollably.

Even though the initial wave of inflation has passed, there's a chance for a second wave in the summer for the US and other developed markets. This could be driven by a higher contribution from consumer goods, backed by a strong labor market and stable wages. This might surprise the market and test policymakers' resolve. It could also weaken the growing market confidence in expected rate cuts by the end of the year.

Implications for the Federal Reserve's Monetary Policy

Over the past 14 months, the Federal Reserve has rapidly increased its benchmark interest rate by five percentage points, the fastest in 40 years. While inflation, measured by the Fed's preferred indicator, has dropped from 7% to 4.2%, it still remains above the target of 2%. Meanwhile, unemployment has hit a record low of 3.4% since 1969. Fed Chair Jay Powell hinted at potentially pausing the central bank's actions to fight inflation, citing uncertainties regarding the economy's response to banking stress. The Fed's choice to raise rates while adopting a wait-and-see approach is justified due to turbulence in the banking sector, stricter lending conditions, and early signs of a slowdown in the US job market.

The April data supports the Fed's goals as good, shelter and non-housing core service inflation has been reported lower. Although some economists are doubtful and think a rate increase in June is possible if the overall economic data stays strong, many others now believe it's more likely that the Fed will pause its efforts. A pause in June seems increasingly likely, but rate cuts by the end of the year are still not expected.

Central Bank Rates

The European Central Bank (ECB) has raised interest rates by a quarter-point, but still faces challenges as inflation rose to 7% last month and the labor market stays strong. The Bank of England is also expected to increase rates soon, with the possibility of more increases in the future. However, global inflation is generally on a downward trend.

Higher interest rates are leading to tighter lending in the US and Europe, which central banks hope will result in slower wage growth. Both the US and eurozone economies face uncertainty, leading the Federal Reserve and ECB to be cautious in their recent rate decisions.

For more analysis on these topics, check out these articles:

Fed policy on right track, but inflation still too high, officials say

Premature for Fed to call end to rate hikes with inflation still high, Williams says

US inflation eases to 4.9% in April as Fed tightening takes effect

Getting close: Federal Reserve chair seeds expectations for pause in interest rate rises

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.