Assessing the Stock Market Landscape Amid Fed Rate Shifts

The Federal Reserve's Interest Rate Decisions and Their Impact on the Stock Market

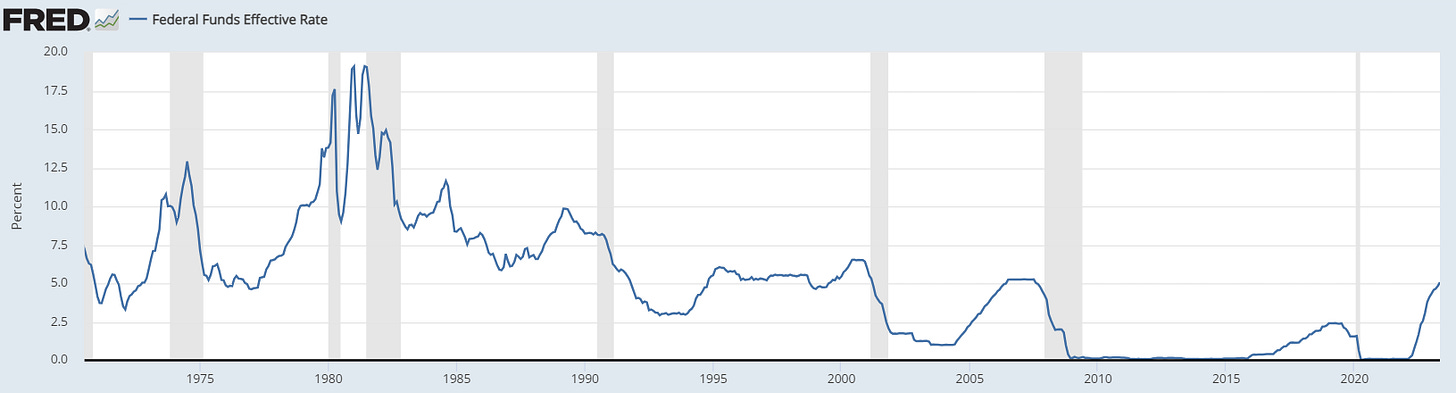

Since 1970, there have been six episodes where the central bank increased rates by more than 100 basis points over a year or longer and then paused for at least three months. These pauses have been beneficial for stocks, with the S&P 500 Index jumping 8.2% on average in the 90 days after such a respite, almost quadrupling its average three-month advance during the period analyzed.

This time, the halt after 10 straight hikes comes with a big caveat: policymakers expect rates will rise further. That would suggest more of a skip than a pause, a very different scenario. But investors are calling the Fed's bluff on its hawkish rhetoric. From Tuesday's close through trading Friday, the S&P 500 jumped 0.9%, the best showing since February from a Fed decision day to the weekend. That pushed the index's rally since October's closing low to 23% and left it about 8% below its all-time high.

There's a difference between a pause and a skip, and we could be underestimating how meaningful that is, according to Gina Martin Adams, chief equity strategist at BI. For example, when the Fed skipped a rate increase in January 1989 and then went back to hiking, the S&P 500 rose over the next three months. But in 2000, when the Fed stopped its tightening cycle in April and resumed it in May, stocks fell 1.5% in the next three months, according to BI data.

The Fed's dot plot showed the majority of voting members see at least two more .25pt hikes this year amid stubbornly high inflation and labor-market strength. However, swaps traders are ignoring the guidance and betting on just one more .25pt hike this cycle, most likely next month. Resuming hikes right away presents a potentially more problematic scenario for stocks.

Investors are optimistic that the Fed won't spur a severe recession as it fights inflation, a notion that helped extend the S&P 500's gains last week. Traders also point to the improving breadth of the stock market's advance, as lagging groups like small caps, materials, and financials join the rally. An equal-weighted version of the S&P 500 is on track to beat its market cap-weighted peer this month for the first time since January. The US economy has been more resilient than expected, according to Anastasia Amoroso, chief investment strategist at iCapital. This exuberance might be justified. Investors are holding on to the belief that US inflation will fall more than the Federal Reserve forecasts, setting the stage for a possible showdown with policymakers who want more interest-rate increases to push inflation back down to 2%. Despite the Fed's guidance that it will likely be appropriate to lift its policy interest rate to around 5.6% by year-end from a current level between 5%-5.25%, bullish investors are largely ignoring this and the S&P 500 and Nasdaq Composite booked their longest streak of weekly advances in years on Friday.

However, Fed officials are talking tough, but it is unlikely they will hike more than one more time before holding rates steady above 5.25%-5.5% for six to 12 months. Since inflation began rising in 2021 after the onset of the pandemic, investors have repeatedly underestimated the Fed's willingness to tighten financial conditions or taken a while to get on board with the central bank's thinking. Inflation has fallen from a 9.1% peak reached last June, as measured by the annual headline rate of the consumer price index, and is showing signs of further easing.

The Role of Tech Stocks in the S&P 500

The S&P 500 has been touted as being in a new bull market, but the gains have largely come from just seven tech stocks: Apple, Alphabet, Amazon, Meta Platforms (formerly Facebook), Nvidia, Microsoft, and Tesla. These stocks have been able to disguise the overall deterioration of the S&P 500 because the index is weighted by market capitalization. This means that companies with large market capitalizations are weighted more heavily, which can distort the value of the index and the overall view of the market.

The market cap of Apple alone is larger than the market cap of all domestic shares listed on the Frankfurt stock exchange. The PE ratios of Amazon and Nvidia are particularly high at 295 and 211, respectively, compared to a typical PE ratio of 20. The seven tech stocks listed above make up 29.6% of the entire S&P 500 index. Three of these stocks have shown percentage gains of more than 100% year-to-date, which is not normal during a Fed tightening cycle. The U.S. markets are no longer efficiently allocating capital, but rather have become a rigged wealth transfer system that benefits insiders while sucking in small investors.

Eric Sterner, Chief Investment Officer at Apollon Wealth Management, believes that the market is overvalued and driven by mega-tech stocks, making it a "house of cards." He predicts a recession in the fourth quarter of this year or early 2024 and is focusing on maintaining or looking at companies or funds that are less sensitive to the S&P 500's direction.

Developments in the Bond Market

Rising interest rates have affected the bond market, causing yields to soar since March 2022. The yield on the policy-sensitive 2-year U.S. Treasury note settled at 4.72% on Friday afternoon, compared to 1.867% on March 15, 2022. Similarly, the yield on the benchmark 10-year Treasury jumped to 3.768% from 2.148% over the same period, with its highest level since 2007 being recorded in March 2023.

Yield-seeking investors helped keep Treasury rates mostly contained between March and May, but the prospect of more Fed rate hikes by year-end has pushed the 2-year yield to three-month highs in June. Meanwhile, the bond market is still pointing toward the likelihood of a US economic downturn, as demonstrated by more than 40 different inverted Treasury yield spreads.

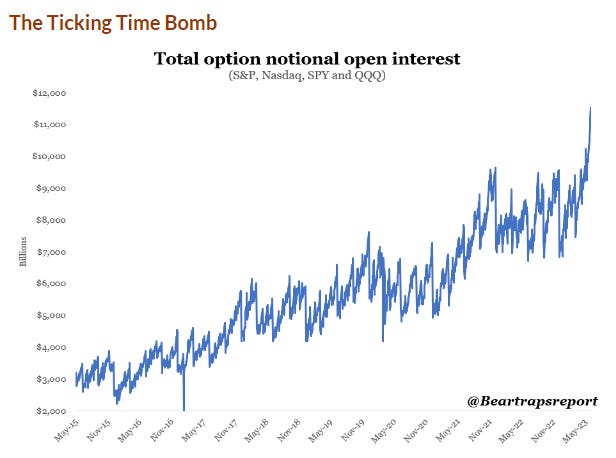

Investor Sentiment and Options Trading

Investors are buying call options at an aggressive rate, indicating a degree of caution that isn't widely appreciated. While the S&P 500 index continues to dance on a razor's edge near record-high territory, options trading patterns suggest that sophisticated investors aren't so optimistic. Many people are skeptical about the current situation in the stock market. They are worried that the recent rise in stock prices is being driven by only a few popular stocks, and this might cause the market to lose momentum or even crash. As a result, more investors are buying call options on various stocks to take part in this potentially risky but profitable situation.

Call options increase in value if the underlying stock price rises, but there's another important feature that's making calls quite popular right now: they let investors control stocks for less money and with less risk than buying equities. That prosaic advantage is often used by institutional investors when they are assembling an investment thesis. While they are doing their research, they buy calls on stocks as placeholders just in case the stock runs away from them before they have reached a conclusion. The bullish call buying comes as other investors are preparing for the worst. They are buying options that would surge in value if the stock market plummets. In recent sessions, there has been heavy trading in call options on the Cboe Volatility Index, or VIX. Unlike calls on stocks, which are a bullish wager, investors buy VIX calls when they think the stock market will sink. If stocks tumble, the VIX increases in value, so calls on the VIX are a way to monetize that fear. VIX trading patterns paint a cautious picture that is at odds with the fear gauge's superficial message that investors aren't concerned about stock risk. With the VIX around 15—a level that suggests little to no fear about the future—investors have bought 155,000 VIX July $23 calls, 70,000 July $27 calls, and about 140,000 August $20 calls. The trading patterns indicate that institutional investors are hedging their portfolios just in case the stock market sinks and the VIX surges.

Potential Threats to the Stock Market

The S&P 500 has risen by about 20% from its closing low in last year's market downturn, technically putting it in bull-market territory. However, several factors could easily send it lower. The Federal Reserve is almost finished raising interest rates as inflation and economic growth have both slowed down. Higher rates weigh on demand for goods and services, with unpleasant effects on corporate profits, so investors are now looking ahead to stabilizing economic growth and an earnings recovery next year. This springs mini-crisis in banking has been patched up, and Congress has raised the limit on government debt, avoiding a default that would have devastated the global economy.

However, several negative forces threaten to slam the brakes on the stock market. The first factor has to do with tighter monetary policy. According to the Bear Traps Report, so-called broad liquidity is down to below $22 trillion from almost $25 trillion early last year. The S&P 500 tends to rise when liquidity increases, falling when it declines. Given where liquidity is now, the S&P 500 should theoretically be at 3400, a roughly 20% drop from here. Less liquidity not only means less money is available for investment in stocks, it implies less cash is available for banks to lend and for consumers to spend. That hurts corporate profits.

Some of Wall Street's biggest bears have recently voiced related concerns. Morgan Stanley strategist Mike Wilson has noted that tighter monetary policy works with a lag, which means the 10 rate increases the Fed has rolled out since March 2022 could have increasing negative effects in the months to come. Wilson has said surveys show that banks are tightening their belts on lending, a shift that stands to eventually make less money available both for businesses and consumers. The likelihood that cuts to spending will follow should drag Wall Street forecasts for S&P 500 earnings per share down by about 16%, he argues, warning that the index could drop to 3700.

Concern is even showing up in the credit market, a dynamic usually not found at the start of bull runs. The average yield on 10-year triple-B bonds is about 1.87 percentage points above the recent 3.7% yield on 10-year Treasury debt, compared with about 1.6 percentage points a few months ago. Wider spreads indicate mounting doubts about the outlook for profits and greater concern that companies won't be able to handle their debts. That isn't what usually happens at the start of bull markets. Those usually begin with credit spreads shrinking, not widening.

For more analysis on these topics, check out these articles:

Is the S&P 500 Setting a Trap for Investors Like the Dot-Com Bust of 2000?

How U.S. financial markets have performed in the past 15 months as Fed rate hikes fueled wild swings

The bulls finally control the stock market and the signs point higher

S&P 500, Nasdaq jump for sixth straight session to end at 14-month highs despite hawkish Fed and ECB

Summer doldrums in stocks put to the test as doubts linger on more Fed rate hikes

Big stock market rally to be followed by big collapse, says BofAs Hartnett

US stocks notch best week since March despite global central bank moves

Big Investors Are Getting Nervous About This Market. This Is Why.

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.