From Boom to Gloom: The Dramatic Turn of Commercial Real Estate Fortunes

Is Office Space Obsolete?

The commercial real estate sector encompasses a wide range of property types, including office buildings, shopping centers, warehouses, and apartment buildings. This sector plays a crucial role in the economy, providing spaces for businesses to operate and individuals to live.

Influences On CRE

Interest Rates

Interest rates are a key factor influencing this sector. When interest rates are low, borrowing costs are reduced, making it more attractive for businesses and individuals to invest. When interest rates rise, the cost of borrowing increases and profit margins get squeezed which reduces investment in this sector. The Federal Reserve's decision to hike interest rates in response to inflation in 2021 has also had a significant impact on the commercial real estate sector. This move put trillions of dollars' worth of commercial real estate underwater.

Bank Lending Requirements

The lending practices of banks have seen a significant shift. A few years ago, it was common to see a loan-to-value (LTV) ratio of around 75%, but now, these ratios have dropped to around 50%. This means that banks are lending less and requiring borrowers to come up with more equity.

Consumer Behavior Changes

The rise of e-commerce has led to increased demand for warehouse and distribution centers while reducing demand for traditional retail spaces. Similarly, changes in work patterns, such as the increase in remote working has led to reduced demand for office spaces.

Inflation

During periods of high inflation, the value of real estate often increases as it is seen as a tangible asset that can retain its value. However, if inflation is accompanied by economic instability or uncertainty, this could negatively impact the commercial real estate sector.

Causes For Concern

Potential Bank Crisis

The current situation in the commercial real estate sector could potentially mimic and even surpass last year's bank crisis, which was triggered by falling bond prices. That crisis was only halted when the Treasury Secretary and Federal Reserve Chairman effectively bailed out every bank in America with loans based on fictitious asset values, along with unlimited taxpayer guarantees through the Federal Deposit Insurance Corporation (FDIC). The FDIC is currently guaranteeing more than $20 trillion in deposits with just over $100 billion, meaning it has only half a penny on the dollar.

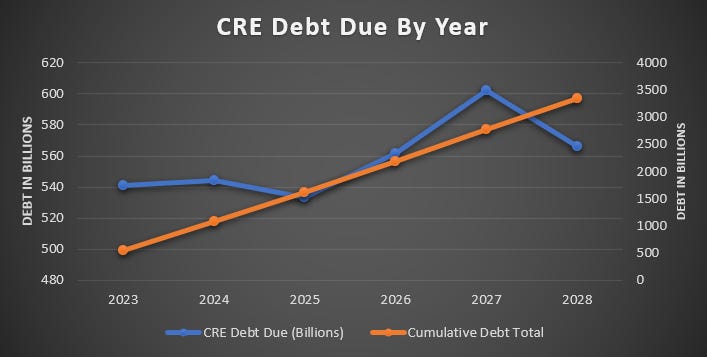

The problem is that nothing was actually fixed during the last crisis, and the situation is getting worse. As the months roll by, more and more debt is coming due. There is currently $929 billion of commercial real estate debt due this year, a figure that is up 28% from last year according to MBA estimates. Trepp estimates that $3.3 trillion will be due by 2028.

The commercial real estate sector is already showing signs of distress, with delinquency rates jumping to 6.5%, a 30% increase in just a few months. The rate of distress in office loans has hit 11%. A recent study from the National Bureau of Economic Research estimated that up to 385 American banks could fail due to commercial real estate loans alone. These would predominantly be small regional banks, which typically hold a third of their assets in commercial real estate loans.

Another study conducted by consulting firm Klaros Group analyzed U.S. banks and found that 282 institutions have both high levels of commercial real estate exposure and large unrealized losses. This combination could potentially force these lenders to raise fresh capital or engage in mergers.

Negative Feedback Loops

There is currently negative feedback loops being driven by the shift to remote work. This is leading to office vacancy losses, loss in property value that then impacts city budgets. City governments, due to balanced budget requirements, are then forced to either raise taxes or cut services. This could potentially lead to more people leaving the city, further perpetuating the loop.

A new study predicts that nearly half of downtown Pittsburgh office space could be vacant in four years. This is a trend that is being seen across the country, with many businesses unable to get all their workers back into the office. The hybrid model of working, which combines in-person and remote work, is becoming increasingly popular. However, it appears that remote work is winning out, leading to a potential 30% reduction in the footprint of office space once leases are renewed.

Office property prices have declined significantly in recent quarters, with an index of office property prices more than 30% below its pre-pandemic level as of September 2023. The U.S. office vacancy rate has risen from 11% in late 2019 to 18% today, higher than at any point during the 2008 global financial crisis.

CRE CLOs

CRE CLOs are a type of security backed by a pool of commercial real estate loans. These bundle debt that would usually be seen as too speculative for conventional mortgage-backed securities into bonds of varying risk and return. They can provide insights into potential liquidity and credit defaults in the commercial real estate space.

The CRE CLO market is experiencing significant stress, with delinquency rates for the hardest hit reaching double digits. To keep CLOs afloat, managers are implementing unprecedented strategies, particularly the buying of delinquent loans through the use of cash reserves. This allows them to avoid tripping asset-coverage tests which would turn off cash-flow streams to certain investors - a mechanism designed to protect those who purchase less risky portions of the structures. Firms have bought back a record 1.3 billion of delinquent loans last year, indicating increased stress in the market. This has forced managers to take unprecedented steps to protect the integrity of their Commercial Real Estate Collateralized Loan Obligations (CRE CLO) structures.

For context, issuance of CRE CLOs jumped from $19 billion in 2019 to $45 billion in 2021, this has significantly dropped to under $10 billion in 2023. As much as 72% of the collateral inside CRE CLOs is backed by multifamily property, with another 13% tied to offices.

Market watchers have noted that the share of loans in CRE CLOs with payments more than 30 days overdue fell to 7.4% last month, down from a peak of more than 8.5% in January. This decrease is attributed to the CLO managers using their reserves to buy back more bad loans from the overall CLO pool.

AI Price Setting

Another significant development in the rental market is the use of Artificial Intelligence (AI) to set rent prices. AI can push property managers to raise rents in ways they might not have considered manually. This technology analyzes a wealth of data, including what nearby competitors charge, to recommend rent prices. This system discourages bargaining with renters and can even recommend accepting a lower occupancy rate to raise rents and increase revenue. This scenario can lead to increased volatility, as the determination of prices by a limited number of rentals may result in more significant price fluctuations. There's also the potential for a scenario where vacancy rates surge, driven by a misalignment between prices and the broader economic landscape.

Thanks For Reading!

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.