Housing Supply-Demand Imbalance. New Home Sales Surge.

Housing Prices Down, Labor Force Up

Housing Market Outlook

Housing remains a crucial factor in the business cycle, contributing significantly to the sharp changes in growth that occur during recessions and recoveries. This is because house prices are very sticky, meaning they do not adjust quickly to changes in the economy. When demand softens, there is minimal price adjustment, but a substantial drop in volume.

The number of homes on the market rose by 3.8% in May to 1.08 million units, but this is still the lowest number of homes that have been on the market during May since data tracking began in 1983. All-cash buyers made up 25% of sales, while individual investors or second-home buyers accounted for 15%. About 28% of homes were sold to first-time home buyers.

Despite the surge in housing starts in May, this has not led to a reevaluation of the overall gloomy view of the housing market or the prediction that a recession is likely on the horizon. Housing starts refer to the number of new residential construction projects that have begun during any particular month, and a surge in this number can indicate increased confidence in the market from builders.

Used Home Sales To New Home Sales Shift

A noteworthy trend in the market is the shift in buyer preferences from purchasing previously owned homes to buying new homes. Sales of previously owned homes have experienced a sharp decline of 20% year-over-year. Conversely, the median price of new single-family houses sold in May fell by 7.6% from a year ago and by 16% from the peak in October. This brought the median price back to $416,300, which is the same level as September 2021.

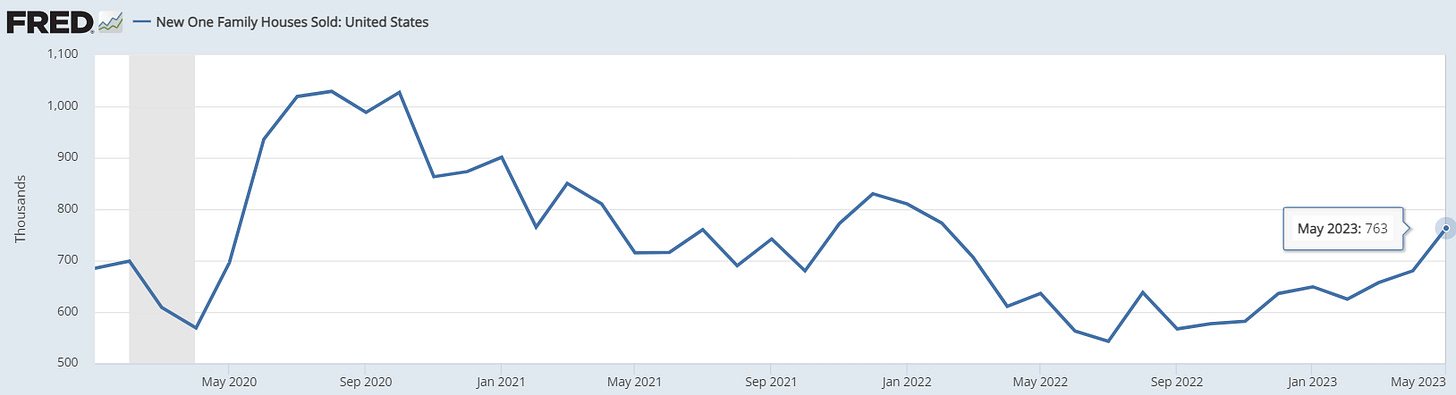

The Commerce Department reported that U.S. new home sales rose by 12.2% to an annual rate of 763,000 in May, compared to a revised figure of 680,000 in the previous month. These numbers are seasonally adjusted and represent the number of homes that would be built over a year if builders maintained the same pace each month. The jump in sales exceeded expectations on Wall Street, as economists had predicted new home sales to reach 675,000 in May.

While the sales figures have improved, they still remain below the levels seen during the pandemic and the housing bubble from 2001 to 2006. However, there has been a notable recovery from the lows experienced in late 2021, and the current sales levels surpass those seen in the years just before the pandemic.

Construction Starts

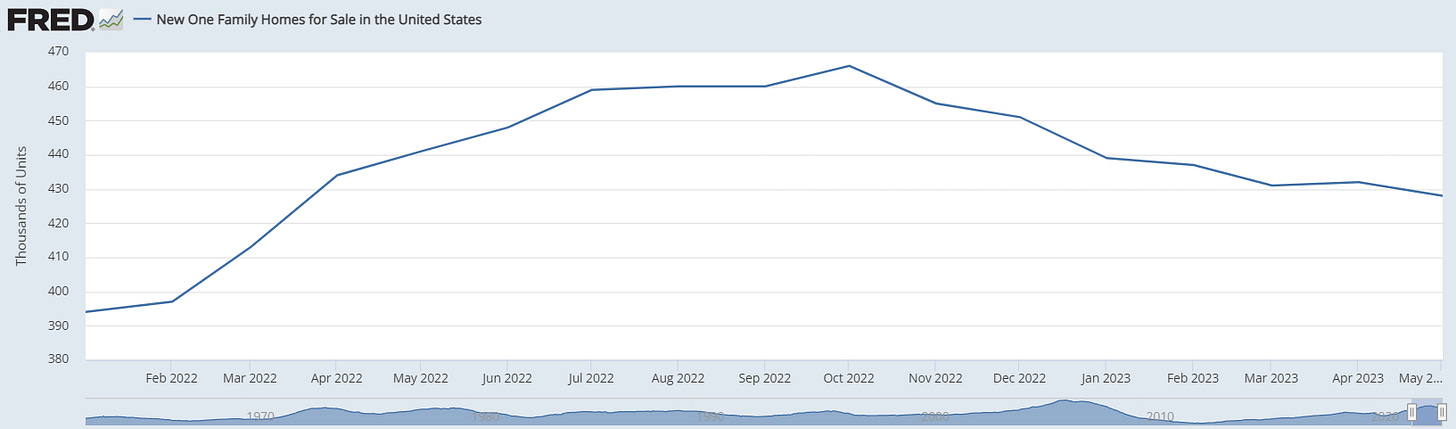

Construction starts of single-family houses have experienced a significant increase in May for the fourth consecutive month. This follows a decline in the second half of the previous year when unsold inventory was accumulating. Although construction starts are still below the peaks observed during the pandemic bubble, they were 18% higher in May compared to May 2019. The supply of homes has decreased from a 10-month supply in July 2022 to 6.7 months in May 2023. This indicates a more balanced market compared to the excessive supply seen previously.

Labor Force Participation & Home Prices

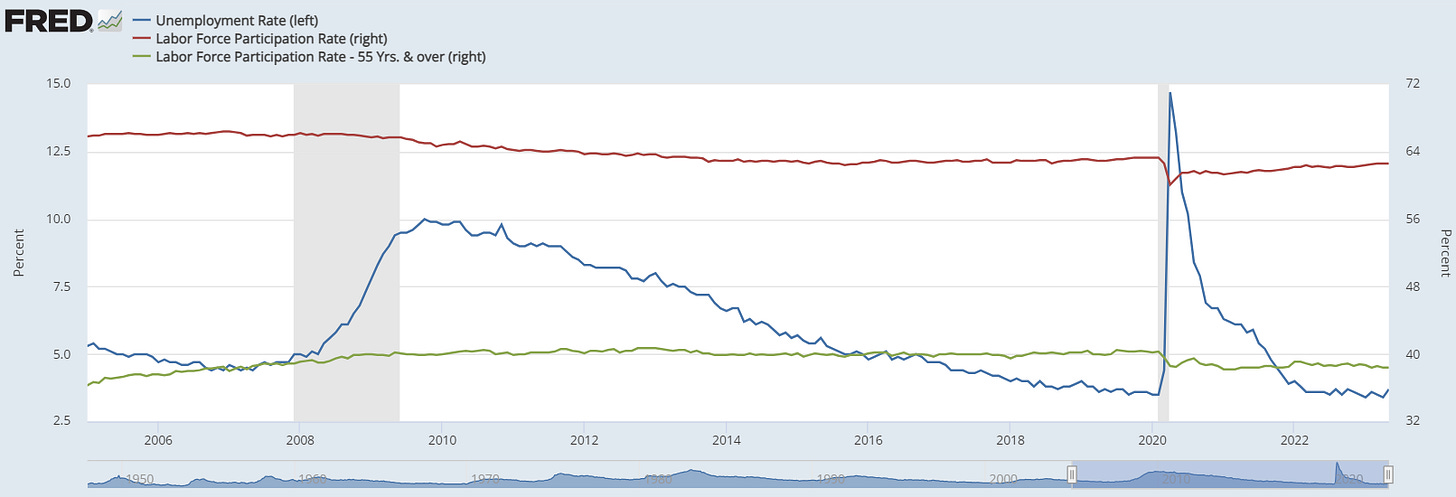

A recent study conducted by researchers at the University of British Columbia has found a correlation between the increase in home prices and the decline in labor-force participation, particularly among older workers. The study suggests that many individuals, especially those in their 50s, 60s, and 70s, were able to quit their jobs during the pandemic due to the appreciation of their homes' value. This will put pressure on the unemployment rate as more people will be added in the denominator of unemployment rate, causing it to increase.

Mortgage Demand & Rates

In June, there was a noticeable rise in mortgage demand, with applications for home purchase loans increasing for the third consecutive week. This trend has led to a boost in sales of newly constructed properties, while the resale market remains relatively slow. Sales of new homes have exceeded levels from the previous year for two consecutive months, whereas sales of previously owned homes were about 20% lower than the previous year in May. This surge is primarily driven by prospective buyers who, despite high mortgage rates and a limited supply of homes, are showing a preference for new homes over those in the resale market.

Mortgage rates play a crucial role in the increased demand for homes. Although rates have not significantly decreased, recent weeks have seen more stability compared to earlier volatile swings. This stability has been advantageous for buyers, as they can better plan their payments. Builders offering incentives, such as mortgage rate buydowns, have further contributed to the uptick in demand. Homeowners with mortgages below 6% are less incentivized to move due to historically low mortgage rates. As a result, the supply of existing homes remains below pre-pandemic levels. A report from Realtor.com noted that the total number of homes for sale is likely to be at its lowest point since 2012.

Supply Demand Imbalance & Impact On New Home Sales

The housing market is currently facing a supply-demand imbalance. The lack of housing inventory is preventing housing demand from being fully realized. Experts argue that this pent-up demand for home purchases has been building due to the undersupply of homes in the market over the past decade. With inventories of existing homes for sale at extraordinarily low levels, more demand has been directed towards the market for new homes, allowing builders to capitalize on the opportunity.

The inventory of homes for sale in all stages of construction increased to 424,000 houses in May from April. This marks the first month-to-month increase after six months of declines since the inventory pileup in late 2021. Compared to May 2022, inventory for sale was down by 3%. The success of lower prices and mortgage-rate buydowns in reducing the inventory pileup has been evident. In April, new home prices were 15% below their peak from the previous October, indicating a significant decline.

Public builders have particularly benefited from this supply-demand imbalance, with about one in four homes listed for sale being new construction, compared to the usual one-in-ten ratio. This is evidenced by the performance of the iShares U.S. Home Construction exchange-traded fund (ITB), which has risen approximately 38% this year, outperforming the broader S&P index.

Spring Selling Season

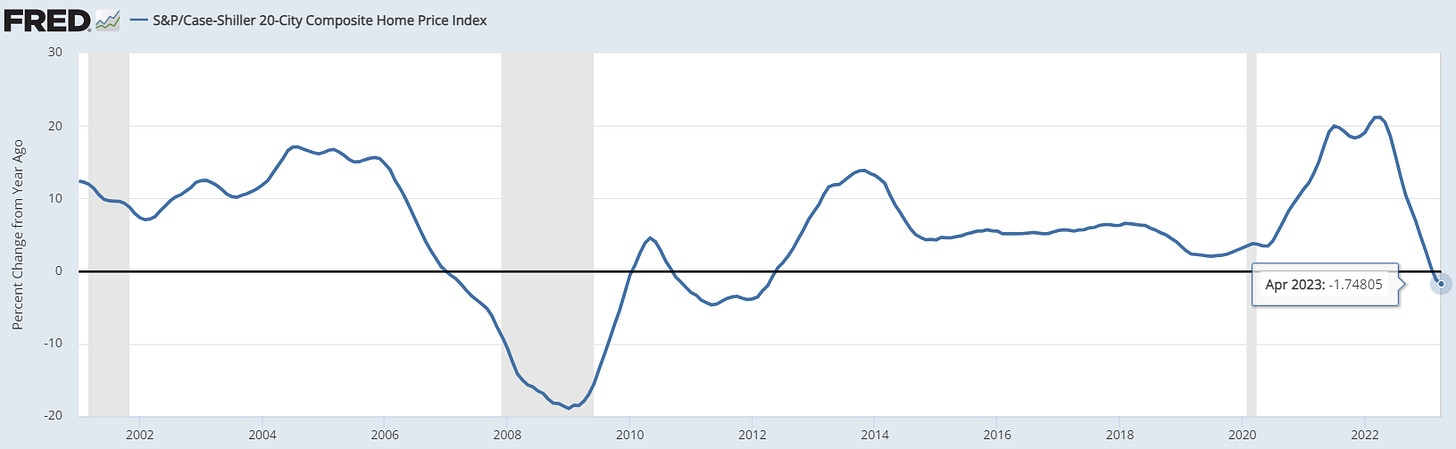

The spring selling season typically sees an increase in sales volume and prices, and this year was no exception. However, the growth was not as significant as in previous years. According to the S&P CoreLogic Case-Shiller Home Price Index, which tracks home prices in 20 cities, there was a 1.7% year-over-year decline in prices, the largest drop since 2012. This decline follows a 1.1% decrease in the previous month. It is worth noting that these declines come after substantial gains during the pandemic.

The Case-Shiller Index uses the sales pairs method, comparing current sales to previous sales of the same houses. The price changes are weighted based on the time elapsed since the prior sale, and adjustments are made for home improvements and other factors. Out of the 20 metropolitan areas covered by the index, 10 experienced year-over-year price declines. Additionally, prices in 19 of these markets have dropped from their respective peaks, which occurred between May and July 2022. The only exception is the New York City metro area, which surpassed its previous high from July 2022.

For more analysis on these topics, check out these articles:

As Prices of New Houses Drop, Sales Jump: Cut the Price and They Will Come.

Blame rising home prices for the Great Resignation, new research suggests

US jobless claims hold at 20-month high, existing home sales tick up in May

Some companies have rather a lot of debt and this might be a problem

Miami and Chicago lead way as U.S. home prices rise in April, signaling a recovery in the sector

Housing Starts See Biggest Monthly Gain Since 1990, but Trend Unsustainable

U.S. existing home prices suffer largest drop since December 2011

The cost of building a new home is rising at an unprecedented rate, Bank of America says

Existing-Home Sales Remain Tepid. Whats Behind the Slowdown.

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.