Job Growth Falls Short of Expectations, Revealing Weaker Private Sector

Unemployment Down, Underemployment Up

Weakness in Labor Market Raises Concerns

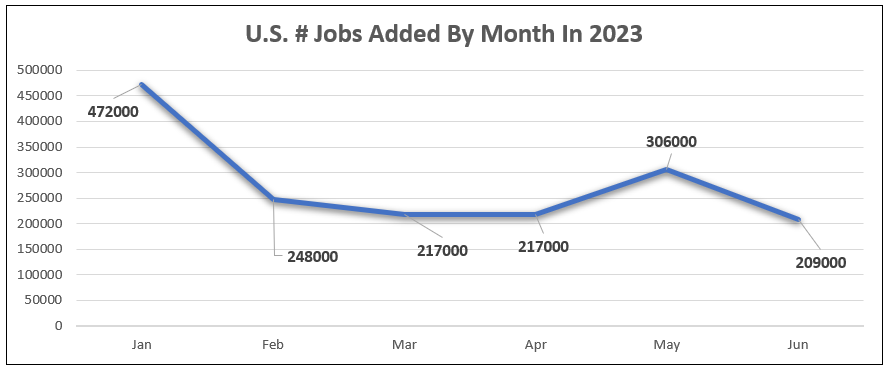

The June jobs report from the U.S. Labor Department has raised concerns about the health of the economy. It showed signs of weakness in the labor market, as only 209,000 new jobs were added, falling short of economists' predictions of 240,000. The report also revealed that job creation in the private sector was weaker compared to the government sector. Around 30% of the new jobs created were in the government sector, while the private sector added only 149,000 jobs, mainly in healthcare and private education. This contraction in private sector employment suggests a slowdown in the economy, bringing it closer to a potential recession. Despite these challenges, the unemployment rate decreased from 3.7% to 3.6%.

Downward Revisions

The hiring numbers for May and April were also revised downward, indicating that the job growth during these months was not as robust as initially reported. The job gains for May and April were revised downward by a combined total of 110,000. This downward revision of job growth figures is a significant indicator of economic cycles and suggests a potential downward trend in job growth.

Unemployment & Underemployment

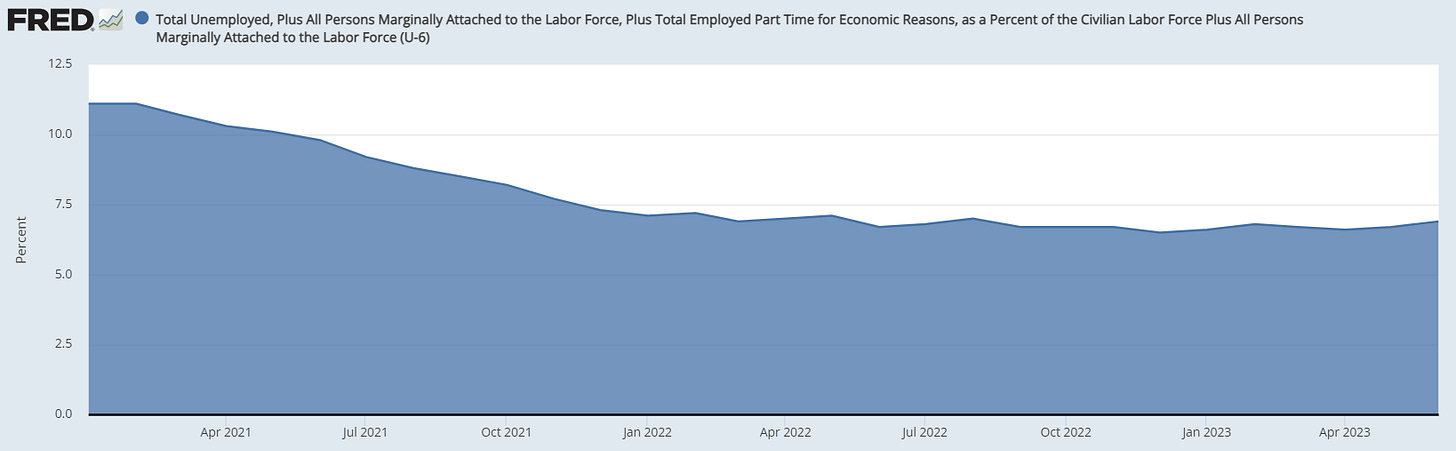

The unemployment rate fell to 3.6% in June, which on the surface appears positive as it suggests fewer people are out of work. However, the broader U6 measure, which accounts for underemployment (people who are working part-time but would prefer to work full-time), rose to 6.9% from 6.7% in May. this number saw its largest increase since the start of the pandemic. This suggests that more people are working part-time because they cannot find full-time jobs or have had their hours cut back.

Employment Population Ratios

The employment-to-population ratio is another important indicator of labor market health. This ratio measures the percentage of the working-age population that is employed. In June, this ratio stood at 60.3%, lower than the 61.2% recorded in February 2020 before the pandemic hit. This suggests that despite claims of resilience, the labor market has not fully recovered.

The labor-force participation rate, which represents the share of people working or actively seeking employment, remained at a post-pandemic high of 62.6%. This high labor-force participation can help to reduce inflation, as companies do not need to raise wages as much to attract workers when there is a larger pool of job seekers.

A notable highlight is the prime-age labor participation rate, which refers to individuals aged 24 to 54 who are either working or actively seeking employment. In June, this rate rose to 83.5%, the highest since 2002. The three-month average also increased to 83.3%. This indicates that people in their prime working age are participating in the labor market at a rate not seen in 20 years.

Open Jobs

The number of job vacancies in the U.S. is declining, with 9.9 million open positions at the end of May, translating to 1.6 unfilled positions for each unemployed person. Although this figure is lower than the record 12 million open positions in March 2022, it remains higher than pre-pandemic levels.

Wage Growth & Hours Worked

In June, hourly pay rose by 0.4%, surpassing expectations and bringing the increase in wages over the past year to 4.4%. To put this into perspective, prior to the pandemic, wages were rising at a rate of less than 3% per year. In comparison, the Consumer Price Index (CPI) for all items increased by 4.1% year-over-year.

The decrease in total hours worked is another indicator of a slowing economy. Although there was a slight rebound in June, total hours worked have only increased by 0.1% since January. This weakness in hours worked is reflected in both weekly and hourly earnings, which have been slowly deflating.

Part-Time & Temporary Services

There was an increase in the number of people employed part-time for economic reasons, which rose by 452,000 to 4.2 million. This increase partially reflected a rise in those whose hours were cut due to slack work or business conditions.

Another area of concern is the decline in temporary help services, which fell to the lowest level since September 2021. Since March 2022, there are 165,500 fewer temporary workers in the economy, the lowest level in almost two years. This decline is typically seen as a leading indicator of a cooling labor market, as temporary staff are often the first to be added when demand is picking up and the easiest to let go when growth slows down.

Employment By Sector

The labor market's cooling is also indicated by an increasing concentration of hiring in a few sectors, as shown by a payroll diffusion index that has reverted to pre-pandemic levels after peaking in February 2022. The payroll diffusion index measures the percentage of industries adding jobs, and a decrease in this index suggests that fewer industries are hiring.

Since the current administration took office, manufacturing employment in the U.S. has grown by slightly less than 800,000 positions. This growth has contributed to the creation of over 13 million jobs as the country's economy quickly recovered from the pandemic. However, the job growth in manufacturing, which stands at 6.5%, is still slower than the overall increase in employment since January 2021, which is around 9.3%.

Healthcare payrolls rose by 41,000 jobs, driven by hiring in hospitals, nursing and residential care facilities, and home health care services. Leisure and hospitality payrolls increased by 21,000 jobs, but employment in this industry remains 369,000 below pre-pandemic levels. Employment growth in the durable goods sector has outpaced that of the nondurable goods sector. Since the start of the current administration, employment in durable goods has grown by 7.2%, compared to 5.3% in nondurable goods.

Construction employment also saw a significant jump of 23,000 jobs, indicating a revival in the housing market. The transportation industry has been a standout performer, with nearly 200,000 jobs added in the past three years, representing a roughly 12% increase. The majority of these job gains have come from the motor vehicle sector. The wholesale industry, a sector often seen as a bellwether for economic health, saw payrolls decline by 4,000 in June. This marked the second negative month in the last three months,.

Market Reactions

The stock market's reaction to the employment report was mixed. The Dow Jones Industrial Average and S&P 500 both fell in Friday trades, while the yield on the 10-year Treasury inched up to 4.1% after the release of the jobs report.

Despite reassurances from Federal Reserve Chair Jay Powell and others, the data clearly shows a weakening economy. The trajectory of this decline is expected to follow a cyclical pattern, starting slowly and then accelerating. It is important to note that this is a non-linear process, and the signs are pointing towards a recession.

For more analysis on these topics, check out these articles:

Landing Still Cancelled: Labor Market Cruises through Updrafts and Air Pockets

Feds Goolsbee says job data show labor market is cooling to sustainable pace

Bruised Bond Investors Face Long Road Beyond Feds July Decision

This is the best possible jobs report economists react to June employment data

U.S. adds just 209,000 jobs in June. Smallest gain since 2020 unlikely to stop Fed rate hike

US manufacturing jobs at highest levels since 2008 but growth is slowing

Wall Street stocks edge higher after US jobs data misses forecasts

Has BLS Overestimated Job Growth in Recent Quarters? Well Know Soon.

Job gains slow, but rising wages, low unemployment keep Fed hikes on track

Fed Needs to Hike Rates to Kill This Job Market. Why Its Stumped.

The Long View of Job Growth by Industry: Some Gained Jobs; at Others, Jobs Got Crushed

The US Labor Market Is Starting to Show Cracks. Here Are the Signs

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.