Level Down, Earnings Season Signals Economic Decline

CEOs are mixed, economy is up yet down.

Earnings Season

The narratives emerging from the business sector during this Earnings Season, coupled with macroeconomic data, suggest a potential recession. The fundamentals of the economy appear less robust than some narratives suggest, with insufficient incomes at the heart of the issue. As consumers run out of options, they will inevitably have to cut back on spending, which will have a ripple effect throughout the economy.

Apple

Apple stock jumped after announcing a $110 billion share buyback program and increased its dividend by 4% to 25 cents per share. The company's fiscal second-quarter revenue fell 4% to $90.75 billion, while net income slipped 2% to $23.64 billion. The company reported a nearly 10% drop in iPhone sales, indicating weak demand for the latest generation of smartphones.

Walmart

Walmart, the retail giant, delivered a substantial earnings beat for the first quarter of fiscal 2025. The company's Chief Financial Officer (CFO) noted that upper-income (100k+) households accounted for the majority of share gains in the quarter. Walmart has observed a continuation of "value-seeking behaviors" among its customers over the past year.

Kraft Heinz

Kraft Heinz experienced a drop in its shares after reporting first-quarter results that missed analysts' estimates. The company's revenue was $6.41 billion, a decrease of 1.2% from the previous year. Sales fell across all three of the company's regional segments, with North America experiencing a 1.2% decrease to $4.83 billion. The company attributed this decline to higher prices and the reduction of Supplemental Nutrition Assistance Program (SNAP) benefits in the United States.

General Mills

General Mills Inc., a leading breakfast and snack food manufacturer, reported a third-quarter adjusted income of $674 million which surpassed analyst estimates. However, the company experienced a 1% decrease in net sales from the third quarter of the previous year. The company has noted that sales have decreased over the last several quarters due to price increases implemented to combat inflation, which led some consumers to switch to cheaper brands. General Mills affirmed its lowered full year guidance projections from December.

Lowes

Lowes, has reported a better-than-expected performance in the first quarter, with sales and earnings surpassing analysts' expectations. The company has maintained its full-year financial forecasts with comparable sales predicted to fall by 2% to 3% from 2023. This cautious outlook is attributed to a continued weakness in consumer demand for big-ticket, discretionary projects.

Home Depot

Home Depot posted mixed first-quarter results, narrowly beating profit estimates & missing revenue estimates. The company attributed this to customers delaying larger projects and purchases, a trend that has been observed in previous quarters due to persistently high inflation and interest rates. A slowdown in home sales is hurting retailers as people tend to spend more on home improvement after buying or selling a home.

Etsy

Etsy experienced a significant drop in its shares following the release of its quarterly earnings, which fell short of expectations. Despite an increase in active buyers on the site, gross merchandise sales (GMS) across the marketplace decreased from the previous year. The company reported first-quarter income of $63 million a steep decline from the $74.54 million income reported in the same quarter of the previous year. The CEO of Etsy attributed this performance to a challenging environment where consumers are reducing their spending on discretionary products. The company also laid off about 11% of its employees in December.

Lululemon

Lululemon Athletica experienced a 15.8% drop in stock following the release of its report for the fourth quarter of fiscal 2023. Despite strong results for the quarter that surpassed Wall Street expectations, the company's guidance for the first quarter of fiscal 2024 spurred a stock sell-off. The Q1 guidance was notably lower than consensus estimates, especially for earnings.

Under Armour

Under Armour has projected a decrease in its fiscal 2025 revenue by a "low-double-digit percentage rate". This includes a significant 15%-17% decline in North America. Under Armour's board approved a stock buyback plan, allowing the company to repurchase $500 million of its own shares over the next three years.

Earnings Report Takeaways

Companies are expecting less growth moving forward, indicating a potential deterioration in the economy. This is evidenced by their projections for lower revenues and earnings, as well as the challenges they face in the retail environment due to high inventories and consumer shifts towards cheaper brands.

The common factors contributing to these challenges include a decrease in consumer spending, increased competition, and higher prices. These factors are expected to continue impacting the companies' performance moving forward, leading to a more challenging business environment.

This trend is characterized by a focus on essential purchases and a shift away from discretionary spending, suggesting that many consumers are dealing with stretched wallets.

Building off the actual earnings reports, there are two metrics that are worth comparing too. These are the Late Earnings Report Index (LERI) & the Conference Board Measure of CEO Confidence.

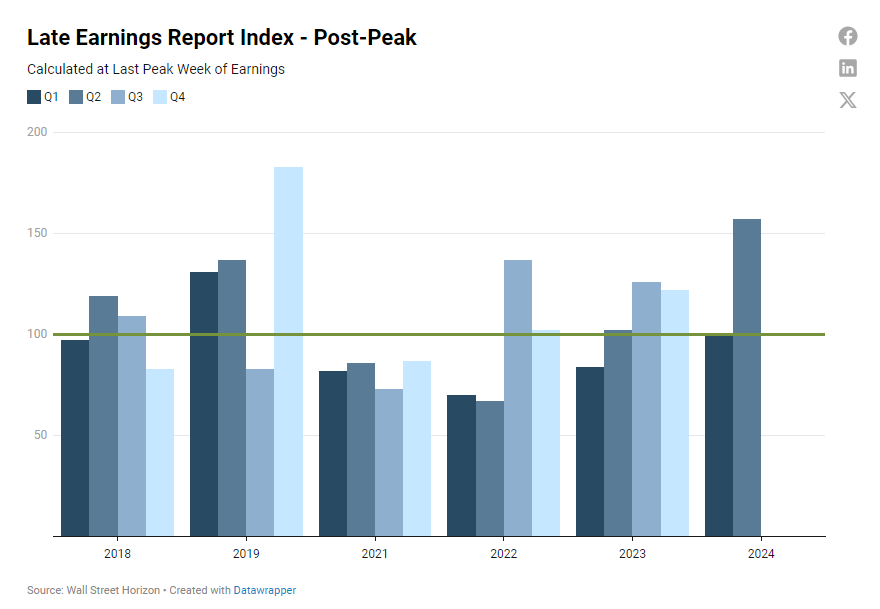

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250 million and higher. A reading above 100 indicates companies are feeling uncertain about their current and short-term prospects.

The Measure of CEO Confidence surveys a sample of CEOs. A measure of 50 is the baseline, with close to 50 being considered cautious, above 50 optimistic outlook and below 50 pessimistic.

Late Earnings Report Index (LERI)

The current post-peak season LERI reading stands at 157. This is the highest its been since Q4 2019, right before the 2020 crash. This indicates that companies are less certain about economic conditions than they were at the beginning of the year. As of May 10, there were 107 late outliers. Link: LERI

Cautious optimism continues to prevail among CEOs

The Measure of CEO Confidence™ rose to 54 in Q2 2024, up from 53 in the previous quarter. This marks the second consecutive quarter in which the Measure is above 50, indicating that CEOs are cautiously optimistic following two years of gloom.

Only 35% of CEOs surveyed in April anticipate a recession within the next 12 to 18 months, down from 72% in Q4 2023. Regarding expectations for their own industries, fewer CEOs expect conditions to worsen, while 46% think conditions will be the ‘same.’ 30% of CEOs expect economic conditions to improve over the next six months, down from 36% in Q1.

The LERI is signaling the opposite of the Measure of CEO Confidence survey. It is quite strange that CEOs in their earnings reports are so cautious about the future and project lower sales and profits and yet they anticipate the US missing a recession. Seems there is a massive mismatch between the survey and what earnings season is telling us. This could be due to only 136 CEOs participating in the survey and being in more resilient industries. As well, there is some mismatch between recession fears being lower according to these CEOs and short term economic outlook being worse.

We might be in a phase where companies are lowering short-term expectations while aiming for higher efficiency. The problem is in today's economy, growth is crucial. Lower growth can impact the entire economy, as the same cycles that boost growth can unwind & lead to its decline. Therefore, earnings reports may be a more accurate indicator of our economic future in this case.

Thanks For Reading!

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.