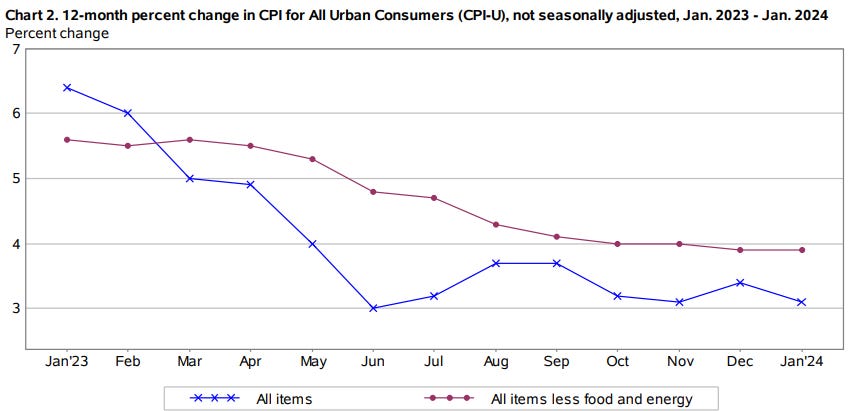

Inflation in the United States rose more than expected in January, primarily due to persistently high shelter prices. The Bureau of Labor Statistics reported a 3.1% increase in January. While the overall CPI dropped from December, the month-over-month data was higher than expected at .4%. Core CPI has hovered near the 4% line for the fourth month in a row, proving to be resilient.

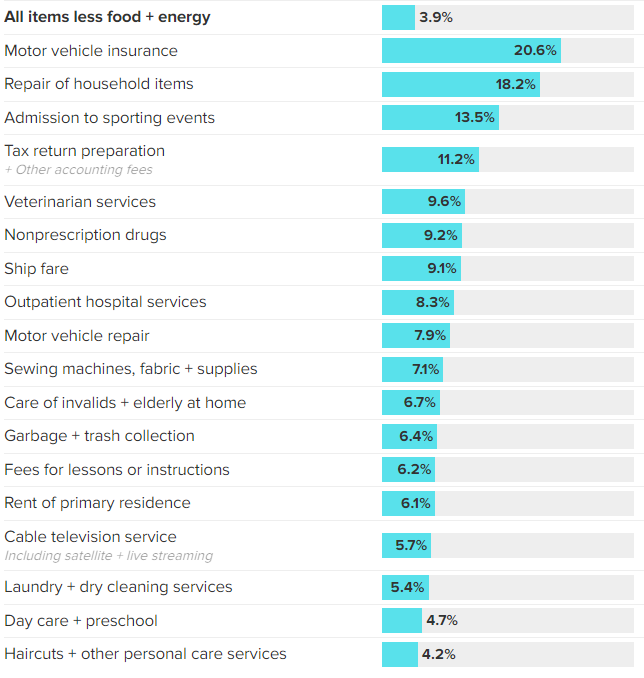

A closer examination of the inflation data reveals some puzzling number. While the overall inflation rate for all items was reported at 3.1%, many individual categories showed much higher increases. (More Below) While the ongoing trend of deflation in core goods continued, inflation in services remained strong.

It's important to note that a lower inflation rate does not mean that prices are falling. It indicates that prices are rising at a slower pace. Consumers are still feeling the impact of higher prices for the items they purchase most frequently. As well its important to know that data from the past 10 to 12 months can be revised, which means that our understanding of inflation during this period may change.

Shelter/Housing

Much of the hotter-than-expected report comes down to sticky housing costs. Shelter costs, which include rents, rose by 0.6% on the month, contributing more than two-thirds of the headline increase. On a 12-month basis, shelter costs rose by 6%.

Interestingly, the real estate industry is puzzled by government data showing housing costs increasing. This is a mystery since apartment rents are no longer rising and single-family rent growth is at low single digits. Private sector data shows cooling costs that have yet to be reflected in the official data.

Food

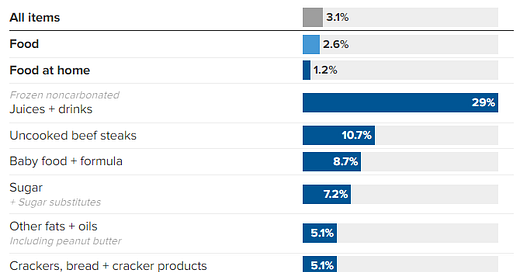

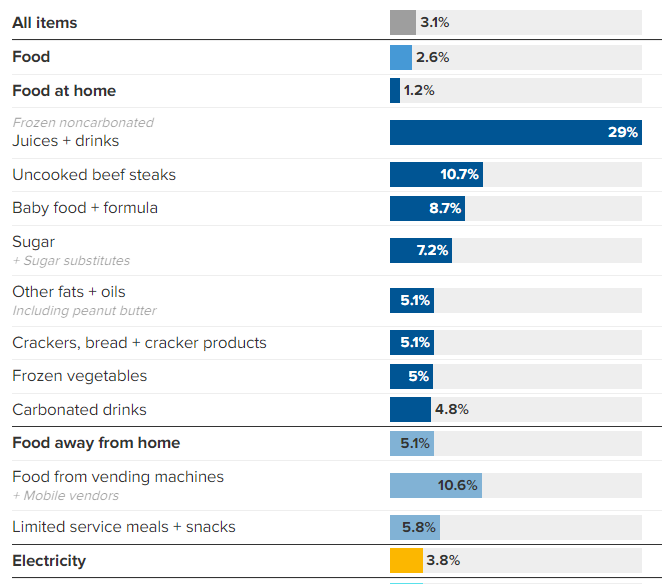

Food prices rose by 0.4% month over month, the largest gain since January 2023. The year over year prices rose by 2.6% overall. Individual items such as juice saw a staggering 29% increase, with beef and baby formula also seeing significant hikes of 10.7% and 8.7% respectively. Similarly, food away from home saw an increase of 5.1%, but vending machines and limited service meals and snacks saw increases of 10.6% and 5.8%.

Inflation By Category

Report Accuracy

The narrative being pushed is that the economy is strong and consumers have no reason to complain. This conclusion is based on a 3.1% increase in overall incomes compared to inflation. However, this 3.1% seems incorrect. Even excluding certain items, most components of the consumer price index are over 5%, far above the reported 3.1%. When housing is included, which has seen a 6% increase, the real inflation figure seems like it should be much higher. Just look at the graphic above.

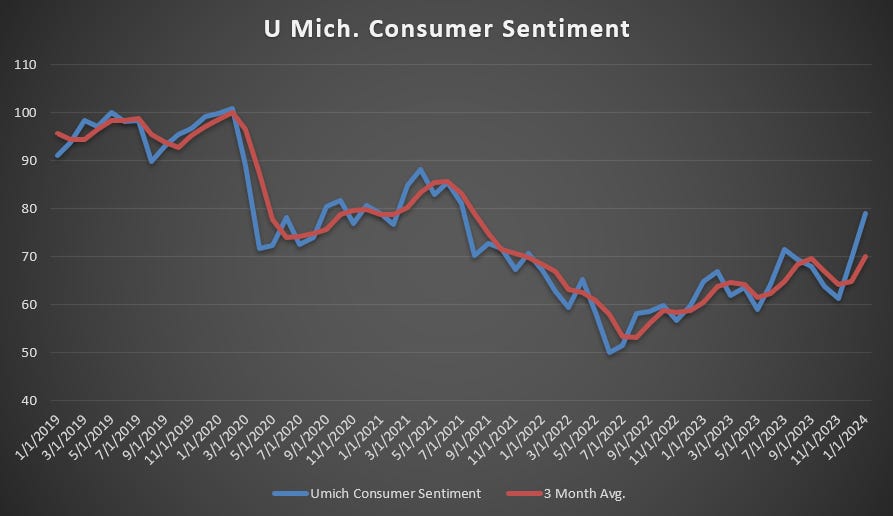

U. Mich Consumer Survey

Despite the inflation report diverging from the deflationary trend, consumer confidence has shown a notable increase. This optimism may stem from a common tendency to conflate stock market performance with overall economic health, particularly highlighted by the significant uplift in sentiment coinciding with the bull market's onset in 2023.

Market Impact

The S&P 500 Index has been on a relentless rally, surpassing a series of troubling markers and reaching 5,000. Over-exuberance is evident in the market, with the S&P 500's 15-week rally pushing the gauge 13% above its 200-day moving average, a phenomenon that has only occurred on 5% of trading days this century.

With the release of the January CPI, the S&P 500 dropped 1%, and the small-cap Russell 2000 dropped 4%. Futures tied to the Dow Jones Industrial Average were off by more than 250 points, and Treasury yields surged higher. 10-year Treasury yields rallied. The increase could send mortgage rates higher ahead of the typically busy spring home buying season.

As well oil prices have remained relatively stable, while gold and Bitcoin have both fallen. This is counter to what would be expected as they are considered inflation hedges. The dollar has risen, increasing the perceived risk in the banking system due to the increased difficulty of servicing dollar-denominated debt outside the United States. In the long run, an environment where bond yields decrease while the dollar increases could indicate a risk-off environment and could signal that a crisis is imminent.

The Fed

The Federal Reserve entered 2024 within reach of its 2% inflation goal. However, the risk that inflation could remain stuck above their 2% target is guiding Fed officials' preference to keep interest rates where they are for now. This is further justified by the January inflation report which surpassed expectations.

As well, January's increase could pose a challenge for the central bank as it seeks to ease its monetary policy. Following the release of this data, the likelihood of a rate cut in May implied by futures markets fell from 50% to 30%, while the chances of a cut in March were almost fully eliminated. Futures markets now price in fewer than four 25bp interest rate cuts in 2024, down from five a week ago.

Thanks For Reading!

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.