Rise of the Memes. GME

MSM blames a tweet, bullshit. Real underlying reason for SURGE in price.

Gamestop soars as Roaring Kitty trader resurfaces. Single tweet leads to 70% increase.

This is the prevailing narrative surrounding GameStop (GME). However, examining the week before reveals a significant 50% surge in stock price, climbing from approximately $10 to $20. Surprisingly, this substantial movement occurred without any corresponding news or announcements affecting the stock.

So what’s actually the underlying reason for this price increase? Why are meme stocks suddenly surging?

Keep in mind that this is a theory, not a confirmed fact, but consider the following.

The surge of forum called WallStreetBets in 2021 revealed a culture of individuals willing to risk it all to reach for better riches. After the meme stock surge in 2021, this community exploded including several others. One community even reached nearly 1 million members specifically focused on GME. Superstonk. This is by far the largest retail supported stock, dwarfing TSLAs reddit which only has 25,000 members.

So what did this reveal?

A couple things:

An increasing rise of a 'YOLO' (You Only Live Once) mentality, characterized by high-risk, high-reward strategies. Mostly 0DTE and far out of the money options.

A growing perception that the economy is excluding many individuals, leading to a belief that adopting such high-stakes behavior is the only path to financial success.

An unearthing of systemic corruption that “allegedly” proves that the market has been rigged against retail investors.(Make sure to watch the information at the end, honestly go ahead and skip to the end of the first two bullet points don’t matter to you)

Now in a small sample size, this behavior would have little effect on the market. But is this community of thought growing?

Lets connect some other pieces here.

Birth Rates:

We have seen birth rates plummet to under replacement levels. This will create a contraction in the upcoming workforce available in the US. But when we look at what makes up birth rates, its really a question of house formation. Why are young people not reproducing?

One issue is the breakdown in incomes between male and females. Women generally will date at their perceived level or above. This can be seen from online dating. This excerpt from a study found by Paul Van Der Laken succinctly sums it up. link

As women's socioeconomic status has improved, they have become more selective in choosing their partners. Another chart showing here shows how income drives tinder engagement as well.

So better looking, higher earning men are what women are after. (Obvi)

So why is this different than the past?

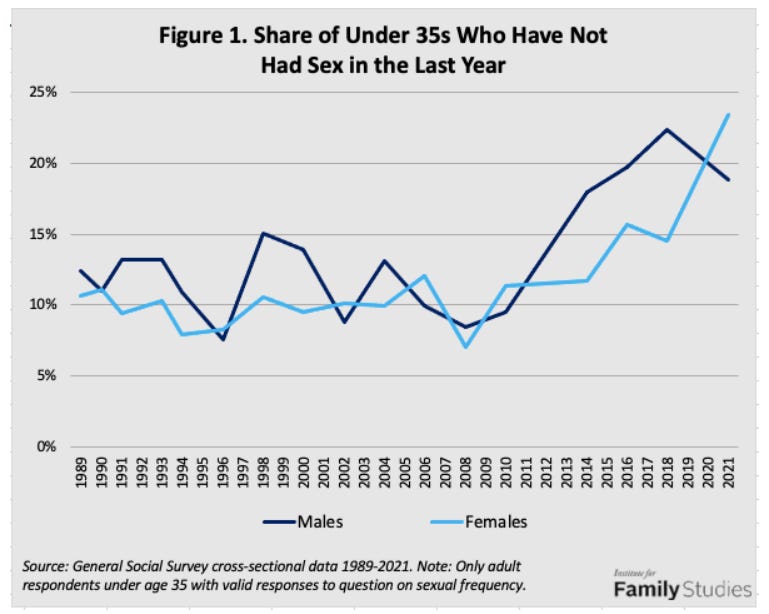

Social media has significantly increased the competition in the dating landscape. Men are no longer competing to be the most desirable in their local community; they now find themselves contending with suitors from across the globe, or at least from a larger geographic radius. This shift has coincided with a noticeable decline in sex, a trend that has become more pronounced since the 2008 Global Financial Crisis. (Chart Below) Two major developments occurred after the GFC: the swift rise of social media and a scarcity of economic opportunities, which were insufficient to accommodate the increasing number of college graduates.

Returning to the YOLO strategy, consider the scenario where men find their potential suitors lacking. In response, they have a couple of options. They can enhance their physical appearance, which is somewhat feasible, or more commonly, they might seek to increase their earnings. If advancing significantly in their careers isn't viable, the alternative is to adjust their risk/reward balance by opting for investments with low odds of success but potentially massive returns. Thus, their investment approach often shifts towards 'moonshot' bets.

This appears to be an emerging trend likely to expand further. Much like the influence of passive investing on future market dynamics, high-risk investment strategies are also poised to leave a significant impact. This trend is particularly evident in the surge of investments in alternative cryptocurrency projects and coins, which has led to a notable increase in subsequent foreclosures.

When you put this information together, you can see a growing community of individuals that are reinforced by social media to treat investments in a more YOLO strategy and to take chances that prior generations would not have concerned themselves with.

Now the final reason for this entrenched meme stock mania investing is basically an f u from investors to large capital players that are capable of manipulating markets. This will require it owns future posts but here are some resources we implore you to explore.

Succinct wrap up of the gme saga. Link

The Great Taking, link. How our brokers have turned our assets like stocks into IOUs that we don’t actually own.

Literally tons of fines and articles about Wall Street committing crimes and paying Pennie’s here.

Thanks For Reading!

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.