Shifting Labor Market Dynamics & Anticipated Federal Reserve Rate Cuts

New Program: Free Money For Active Subscribers

2024 New Initiative

To reward our avid subscribers we are launching a new program in 2024. We will be running a monthly tournament where all active subscribers will have a chance to win $100 amazon gift card. If this program is very successful we will up it to $250.

To enter subscribe to our new platform here.

To understand how this tournament will work click here.

Current Status of US Labor Market

The job openings report just dropped and showed that total job postings declined more than 15% from a year earlier. Despite this decline, job postings are still up by more than a quarter from their pre-pandemic levels. Much of the strength in hiring in 2023 was for in-person positions, such as in nursing, child care, food service, and bars.

However, the solid labor-market data is hiding the pain of those stung by recent layoffs. The current low unemployment rate is allowing state legislators to keep payouts for unemployment insurance low. Five states have weekly payment maximums below $300, despite inflation that's increased the price of an average basket of goods and services by almost 20% since 2020. In comparison unemployment benefits were at $600 per week on top of regular benefits after COVID. However, if the nation falls into recession, which many economists still expect, this approach could lead to a reckoning.

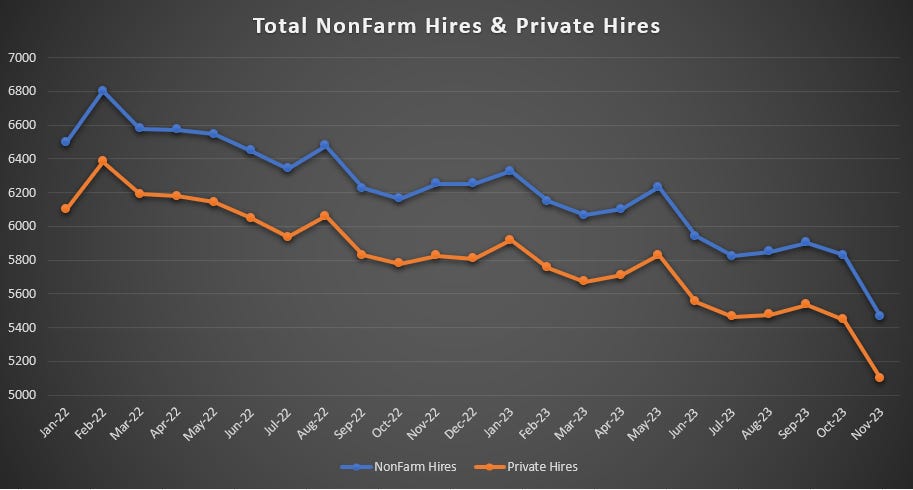

The unemployment benefits situation is further complicated by the fact that it is taking longer for people to find work, as evidenced by the number of people applying for recurring unemployment benefits hitting a two-year peak in mid-November. As well there has been a noticeable decrease in the number of new hires. The number of hires has dropped significantly, with the figures falling below the low points observed in the years preceding the pandemic. This is attributed to fewer people quitting their jobs and fewer layoffs, resulting in fewer vacant positions to fill.

This has resulted in a less frenzied labor market. Job growth became more concentrated in a handful of industries: healthcare and social assistance, leisure and hospitality, as well as state and local government. Outside these sectors, hiring slowed sharply and in some areas contracted.

The less dynamic labor market has helped put a brake on rapid wage growth, a key consideration for the Federal Reserve. Average hourly earnings across the private sector rose at an almost 6% annual pace early in 2022 but cooled to 4% near the end of 2023.

Another warning sign for the labor market is the downward slope of temporary hiring for more than a year. Temporary workers are often considered a bellwether for the labor market as they are often the first hired when businesses start staffing up and the first dismissed when the economy sours. Another warning sign is the ongoing transformation driven by AI. Almost every role is expected to be redefined in the context of AI, from engineers to salespeople, marketers, finance professionals, and lawyers.

Looking back, the 2023 labor market added an average of 312,000 jobs a month in the first quarter, but that number fell to an average of 175,000 in the fourth quarter. The government will revise its unemployment data for the past five years. Normally these changes are tiny, but if the revisions are unusually large, it could force economists to revisit prior assumptions about the labor market.

December FOMC Minutes

The Federal Open Market Committee (FOMC) has indicated an increased optimism about the path of inflation, noting clear progress. This optimism is reflected in the committee's willingness to cut the benchmark lending rate in 2024, should the current trend continue. However, the timing of such a move remains uncertain. The minutes from the FOMC meeting reveal that almost all participants, reflecting improvements in their inflation outlooks, implied that a lower target range for the federal funds rate would be appropriate by the end of 2024.

Expectations for the federal funds rate at the end of 2024 varied widely among officials. The Fed's 'dot plot' showed eight officials saw two quarter-point cuts or less, while 11 officials expected three or more. The post-meeting statement highlighted this shift in tone. Futures markets have been anticipating the Fed will cut rates six times this year, beginning with a likely quarter-point reduction in March. According to the CME FedWatch tool, there is a 72% probability of a quarter-point reduction in March. However, several Fed officials have cautioned against expectations of an imminent policy move. Officials slowed the rate of increases last year after a series of rapid hikes in 2022.

Markets 2024

Turning to Wall Street, there is a sense of optimism about the stock market as we enter 2024. Stocks rose through much of 2023, powered by an economy that stayed stronger than nearly all of Wall Street had anticipated. The recession that investors had largely agreed was imminent never came. Behind the dramatic turn in attitude is a growing belief among investors that the Federal Reserve's campaign to fight inflation is winding down, ending the interest-rate hikes that buffeted markets in recent years. This shift in market dynamics seemed unlikely just months ago, but now it appears to be a reality.

The market's recent gains, particularly those in 2023, have helped to alleviate some of the gloom. The past year saw a robust rally across nearly all asset classes, including stocks, bonds, gold, and cryptocurrencies. The S&P 500 returned 24% in total.

Investor sentiment remains positive, with a December survey by BofA Securities revealing that fund managers were more optimistic than in any month since January 2022. More than 90% of participants, who collectively manage $691 billion of assets, predicted that the Fed is done raising interest rates. More than 60% expect lower bond yields in a year, a record high for the survey.

There is some skepticism towards the 'Magnificent Seven' group of big technology companies that dominated the market in 2023. Nearly half of survey respondents identified owning shares of these seven firms as the most crowded trade on Wall Street, indicating limited future upside. Uncertainty stemming from the upcoming presidential election and potential shifts in fiscal policy also pose potential risks for markets. Historically, the S&P 500 has risen in 82.9% of presidential election years since 1929.

Thanks For Reading!

If you want to advertise your business to the 200,000+ readers of this newsletter, learn more here.

To Subscribe With Our New Beta Platform Click here.

To Read Past Newsletters Click here.