The Echoes of Rates

Rising Yields Re-Shape The Economy

The 10-year Treasury yield reached its highest level since 2007, just below 5%, before slightly declining. Similarly, the 30-year Treasury rate also experienced its highest close since 2007 before pulling back. The bond market has also seen increased volatility compared to historical levels. The ICE BofA MOVE Index, known as the bond market fear gauge, reached its highest level since May, hitting 142 in early October. As of Friday, it stood at around 135.5. This heightened volatility in the bond market has added to the concerns of investors.

U.S. Treasury Supply & Demand

The surge in yields on longer-dated Treasury securities can be attributed to the supply and demand dynamics in the market. The government's substantial issuance of these securities to finance its deficits has created a need for higher yields to attract buyers. While international holders continue to buy Treasury securities, they are not keeping up with the pace of issuance. As well the Fed has been reducing its Treasury holdings through quantitative tightening (QT). As a result, yields must rise until every last security is purchased by the public.

If investors become more worried about a recession, the trend may reverse as they price in slower inflation and a lower fed-funds rate. However, with the 10-year yield nearing 5%, these concerns are not currently at the forefront of investors' minds.

The cyclical nature of bond markets, alternating between bull and bear markets, is a well-established phenomenon. The last bond bull market spanned approximately 40 years, while the preceding bear market lasted around 33 years. This pattern suggests that we may be on the cusp of a generational bear market.

U.S. Debt

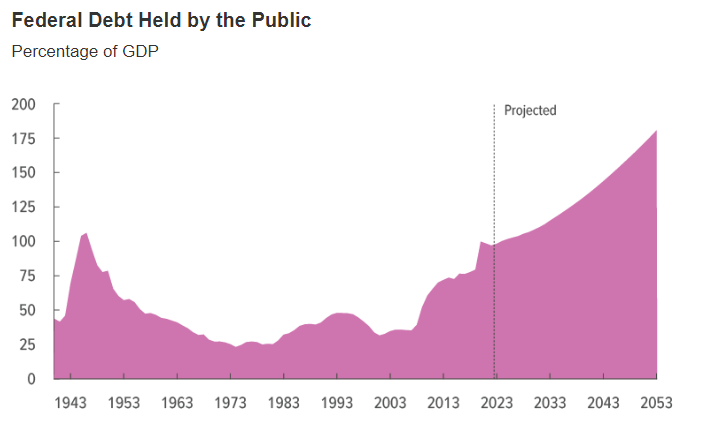

The surge in bond yields serves as a wake-up call for Washington, highlighting the urgent need for serious budget reform. The U.S. budget deficit currently stands at 8% of gross domestic product (GDP), a significant figure considering the economy is at full employment. Furthermore, the public debt is already at its second World War high. Without significant changes to current budget policies, there is little hope that the public debt will cease its rapid growth.

The Congressional Budget Office has projected that by 2029, the federal debt held by the public, relative to GDP, would surpass its historical peak and reach 107%. This alarming forecast underscores the urgent need for fiscal responsibility and sustainable budget policies. Source.

U.S. Mortgages

In the mortgage market, the average 30-year fixed mortgage rate has reached 8%, the highest since 2000. This increase in rates has led to a collapse in mortgage applications to purchase a home, which are now at a multi-decade low and 48% below the same week in 2019. Mortgage applications serve as an indicator of future home sales volume, which has already experienced a significant decline. Additionally, mortgage applications to refinance a home have plunged by 10% for the week and are down by 87% from the same week in 2019. Most of the refinances are cash-out refis, while non-cash-out refis have essentially disappeared, down about 97% from the previous year.

U.S. Equities

According to Jose Torres, a senior economist at Interactive Brokers, the increase in the 10-year Treasury yield has a direct impact on the valuation of the S&P 500. For every 40 basis points increase in the 10-year Treasury yield, the S&P 500 multiple theoretically decreases by one point. Over the past three months, the 10-year Treasury yield has risen by 108 basis points, implying that the S&P 500 multiple should drop by almost three points.

The price/earnings ratios of staples and the S&P 500 over the past five years reveal that staples have generally traded at a premium, except during the rapid recovery of 2020-2021 when riskier, growth-oriented stocks outperformed. This pattern is reminiscent of the dot-com bubble. The premiums observed during the mid- and late-cycle periods for staples may no longer be relevant. The S&P 500's price-to-earnings ratio currently stands at 24.22. Source. The Consumer Staples Select Sector SPDR ETF has lost 9% since mid-July.

Federal Reserve’s Response

The outlook for the Fed's interest rate policy has been clouded by mixed economic data and geopolitical tensions arising from the Israel-Hamas war. Powell stated that the highly elevated geopolitical tensions pose important risks to global economic activity, with uncertain implications. Additionally, the increase in US borrowing costs has made it more challenging for the Fed to determine how much higher to raise interest rates in its efforts to control inflation.

The yield on the benchmark 10-year Treasury note reached its highest level since July 2007 after Powell's remarks. However, the yield on the two-year Treasury note, which reflects interest rate expectations, dipped as investors bet that a quarter-point rate increase at the next Fed meeting was unlikely.

Some officials, including Lorie Logan, president of the Dallas Fed, and governor Christopher Waller, have suggested that the surge in yields could offset the need for further rate hikes this year. Previously, Fed policymakers indicated that they believed at least one more rate increase would be necessary to combat inflation.

Effects Of Federal Reserve’s Monetary Policy

Traditionally, monetary policy has been viewed as a tool for managing demand throughout the business cycle, with limited lasting effects on supply. From the perspective of monetary policymakers, supply is influenced by external factors such as regulations, taxes, and productivity. This viewpoint, championed by Milton Friedman decades ago, suggests that potential output is independent of monetary policy.

The current economic cycle challenges this conventional wisdom. Following a period of historically rapid monetary tightening, the desired effects are becoming evident. Rising delinquencies in auto and credit card payments are weighing on consumer staple sales, adding to a list of economic indicators including depressed existing home sales, increased corporate defaults, and contracting profits. Despite this, supply has rebounded from pandemic disruptions and appears to be largely unaffected by high interest rates.

In a recent paper presented at the Feds Jackson Hole conference, economists Yueran Ma and Kaspar Zimmermann raise concerns about the potential negative impact of monetary policy on the supply side of the economy. They argue that rate increases may hinder innovation investment in two ways: through reduced demand and financing. To examine this, Ma and Zimmermann analyzed indicators such as nationwide investment in intellectual property products, early- and late-stage venture capital deals, patent filings for disruptive technologies, and public companies' R&D spending.

Across all measures, the authors find that there is a decrease in innovation investment in the years following a 100 basis point increase in interest rates. The decline is particularly significant for venture capital funding, which can decrease by as much as 25% within three years. Patenting in disruptive technologies also falls by up to 9%. They highlight the asymmetry of monetary policy, where tightening depresses long-run GDP while monetary loosening does not have a corresponding benefit.

Thanks For Reading!

If you want to advertise your business to the 200,000+ readers of this newsletter, learn more here.

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.