The Economic Landscape: Banking Vulnerabilities, FED Interest Rate Disagreement, and Credit Crunch Impacts

Services Demand Propping Up the Market

Here is what we will be getting into today:

Economic Insights & Predictions

Services Sectors Drive Growth

Let's Dive In!

The Current Economic Landscape

Earlier this year, a banking crisis occurred which was caused by two factors: increasing interest rates and banks borrowing heavily from the Federal Home Loan Board (FHLB). Increasing interest rates decrease the value of assets that are income streams, such as mortgages, which can lead to potential solvency crises for banks. When banks borrow heavily from the FHLB, it is a sign that a financial crisis is imminent.

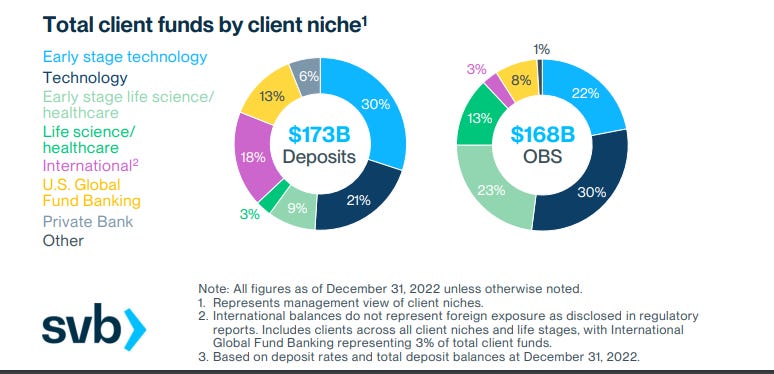

The vulnerability of Signature Bank and Silicon Valley Bank was identified due to their heavy reliance on specific industries and clientele. Banks that heavily rely on specific industries and clientele are vulnerable to liquidity problems and solvency crises because if those industries or clients experience financial difficulties, the bank's assets may become illiquid or lose value. This can lead to a situation where the bank is unable to meet its obligations to depositors and creditors, resulting in a liquidity crisis. Additionally, if the bank's assets lose value, it may become insolvent, meaning that its liabilities exceed its assets. This can lead to a solvency crisis, where the bank is unable to repay its debts and may be forced to declare bankruptcy.

The recent interest rate hikes by the Federal Reserve are causing a bust in the artificial boom that has been building for the past 15 years. The Fed has been creating trillions of dollars in new currency units over the past few years, which has resulted in inflation rates that are higher than what is officially reported. The Fed's attempts to prevent businesses from failing and picking winners and losers in the market can have many unintended consequences. The best solution from an Austrian point of view is to eliminate central banks altogether and allow for a free market in money and banking.

The Federal Reserve's plans for interest rates are causing disagreement between officials and the markets. While Federal Reserve President Bostic expects the Fed to continue hiking rates, he has no plans to cut rates at any point. However, the markets are predicting an 87% chance of a quarter point rate hike next month, followed by a half percentage point cut by the end of 2023. The disagreement between Bostic and the markets centers on inflation, with Bostic believing it is still running too strong to consider cuts, while the markets question believes opposite.

Recent data suggests that the initial effects of the credit crunch may be starting to impact the real economy. Anecdotal evidence from a Florida theme park shows an unusually large drop in attendance for this time of year, which could suggest that people are getting nervous and not booking trips. This evidence is in line with reports from the Federal Reserve's beige book, which highlights signs of deflationary forces hitting parts of the economy, and small businesses reporting mass layoffs.

Services sector drives economic growth in UK and US, while demand for goods declines.

The latest surveys released by S&P Global indicate that business activity in both the UK and the US has accelerated in April. In the UK, the S&P Global UK composite purchasing managers index rose to 53.9, beating analysts' consensus forecast of 52.5, marking the third successive month that the index remained above 50. This indicates that the majority of businesses have reported a month-on-month expansion. The pick-up in activity was driven by strong growth in the services sector, where the index rose to a 12-month high of 54.9 this month. Consumers were more willing to spend on travel, leisure and entertainment, resulting in a significant surge in demand for services, while there is a continuous decline in demand for goods, making the current growth pattern imbalanced.

Similarly, in the US, the Composite PMI Output Index, which tracks the manufacturing and services sectors, rose to 53.5, its highest level since May 2017, while the services sector PMI rose to 53.7, its highest level in a year. This indicates that businesses in the US are also experiencing a strong expansion in economic activity. In the eurozone, the Composite Purchasing Managers' Index rose to an 11-month high of 54.4 in April, with the services industry PMI soaring to 56.6 from 55.0. However, the manufacturing PMI fell to 45.5 from 47.3, its lowest level since the coronavirus pandemic began.

The surveys suggest that economic activity is picking up in many parts of the world, particularly in the services sector. The main concern is the ongoing downturn in demand for goods and the impact this could have on manufacturing industries. Respondents widely reported that April marked another month of strong wage inflation, which contributed to an increase in the prices they charged.

The annual rate of UK inflation was 10.1% in March, down only slightly from 10.4% the previous month and still not far below its October peak of 11.1%. Analysts believe that the central bank is likely to increase interest rates for the 12th consecutive time, beyond the current 4.25%, when the Monetary Policy Committee meets on May 11.

For more analysis on these topics, check out these articles:

Economic Outlook

Fallout from disastrous March is already showing up in these places.

Transitory or Terminal? It depends on what the meaning of the word 'is' is.

John Titus: More Too Big To Fail Banks & More Bailouts Coming? US Gvmnt Spending Finally A Problem?

Bob Murphy: Fed Rate Hikes Accelerating Bust (Commercial RE & Banks) In Austrian Boom Bust Cycle?

5 Economic Disasters We Were Warned About In Advance That Are Happening Right Now

PMI

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

We also offer a paid service which will give a breakdown of every source we cover that will be sent out almost daily.

Our Wednesday newsletter will always be free, but to make sure YOU are not missing anything be sure to sign up for our paid subscription.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.