Unpacking the US GDP Report

Is Government Spending Driving GDP Growth?

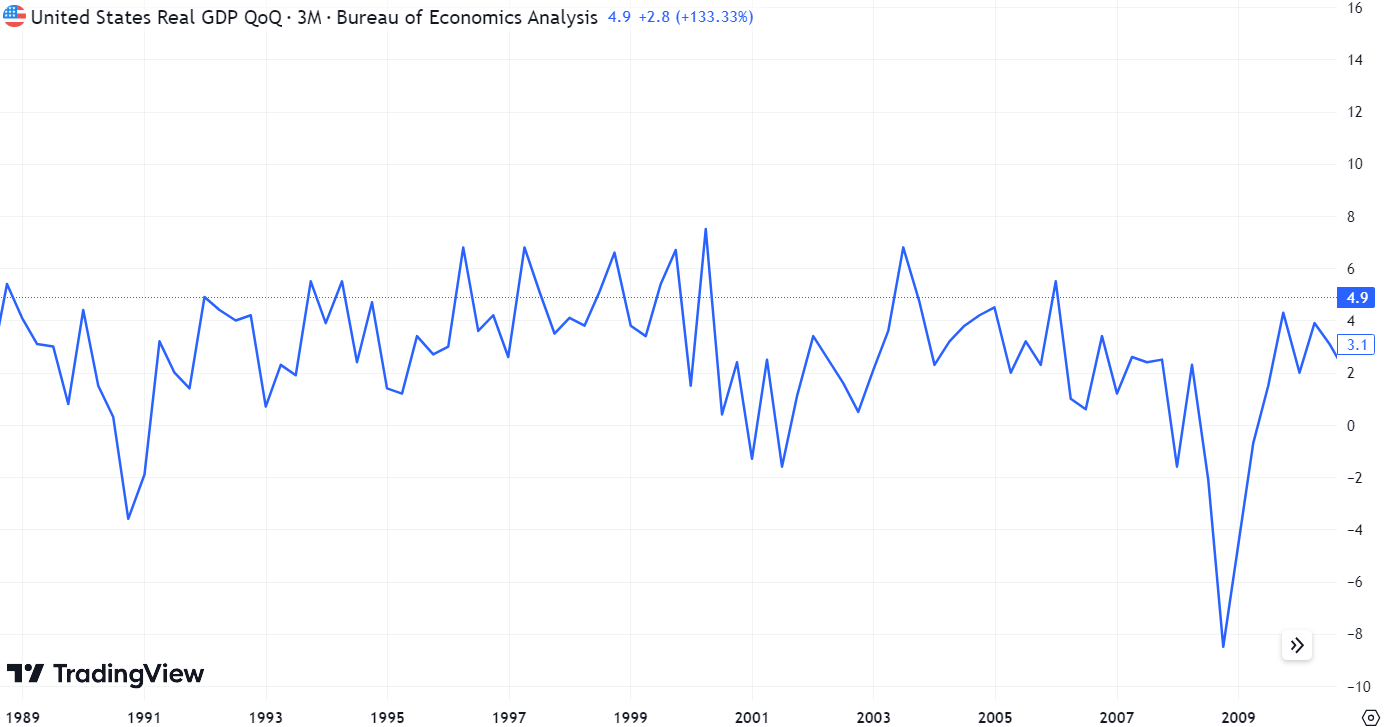

The United States economy, as depicted by headline figures, appears to be thriving. However, a more detailed examination reveals some concerning weaknesses. The real Gross Domestic Product (GDP) growth reached 4.9% in the third quarter, surpassing the consensus estimate of 4.5%. Despite this seemingly positive growth, some analysts had expected even higher growth.

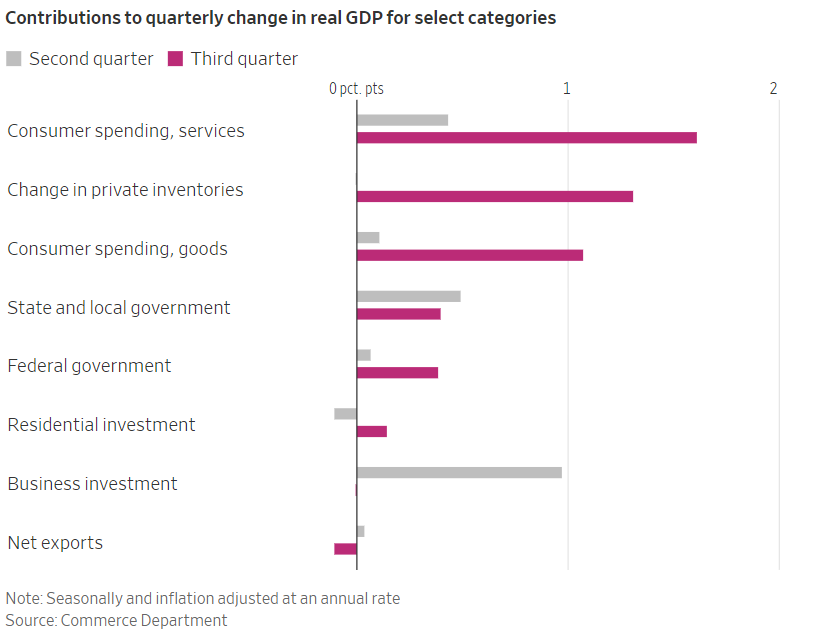

The increase in GDP was largely driven by consumer spending, which accounted for 2.7 percentage points of the overall growth. However, this spending came at the expense of savings, as real disposable spending contracted for three consecutive months through August.

Many forecasters believe that the economy will start to soften in the final months of 2023. S&P Global projects a growth rate of 1.7% in the fourth quarter. It is important to note that the strong growth rate in the third quarter does not eliminate concerns about a potential recession. In the past, the economy has experienced rapid expansion just before the onset of recessions. For example, prior to the Great Recession in 2007-2009, the economy grew at a solid pace of 2.5%. Similarly, in the first quarter of 1990, GDP grew at a robust rate of 4.4% shortly before a recession began.

What is GDP?

GDP is a comprehensive measure of a nation's overall economic activity. It is the total value of all finished goods and services produced within a country during a specific period. The GDP report is divided into four main components: consumer spending, business investment, government spending, and net exports. Each of these components provides a snapshot of economic activity in different sectors, contributing to the overall GDP figure. It can impact everyone in the society, from businesses making decisions about investments, to individuals planning for retirement, to government crafting fiscal policies.

GDP figures can sometimes be misleading as they do not fully capture the health of an economy. They often overlook factors such as income inequality, environmental degradation, and the quality of goods and services produced. Furthermore, GDP does not account for unpaid work and does not consider whether the growth is sustainable in the long term. It should not be used in isolation to assess the overall well-being of a nation.

Consumer Spending

In the third quarter, consumer spending, which accounts for about 70% of U.S. GDP, increased by 4%. This surge in spending was driven by purchases across a wide range of goods and services, including cars, restaurant meals, vacations, concert tickets, and sports events. However, this growth was driven largely by increased borrowing, particularly in the entertainment sector.

While services saw a rise of 3.6%, real disposable income remained negative (-0.1%), and household credit card debt reached a new record high. The average consumer now carries a debt of $5,900 on their credit card, with credit card interest reaching $105 billion last year. The personal saving rate fell to 3.8% in the third quarter, down from 5.2% in the second quarter, suggesting that households may have less buffer for future purchases.

This reliance on borrowing is concerning, especially as real salaries have remained in negative territory for the past five years and inflation erodes savings. The cracks in the bullish economic story are likely to become more apparent soon.

Business Investment

Further analysis of GDP figures reveals additional weaknesses. Real private fixed investment, were slightly negative in the third quarter. This suggests a possible credit crunch in commercial and industrial loans and a general sense of pessimism in the business sector. Nonresidential business investment, including equipment investment, experienced a decline of 0.1%. The construction sector, which had shown a double-digit increase in the previous quarter, fell to just 1.6%. Additionally, forward-looking demand concerns are influencing prices more than current demand, as evidenced by falling crude oil prices and low gasoline prices despite an apparent booming U.S. economy.

Businesses built up their inventories of goods, contributing 1.32 points to the 4.9% GDP growth. However, this could indicate that retailers were unable to sell as much as they had hoped, suggesting an overestimation of demand. Residential investment rose by 3.9%, marking the first positive contribution from this category since the first quarter of 2021. The industrial side of the economy has also received significant support from government investments in green energy and increased military aid to Ukraine. These investments have prevented manufacturers from experiencing a significant decline.

Government Spending

The role of government spending in this growth is particularly noteworthy. The government has been deficit spending to the tune of trillions of dollars each year. This spending contributes to GDP growth, leading to a somewhat distorted picture of the economy's health. This situation can be likened to a person on life support whose vital signs appear healthy due to the support systems in place. If these support systems were removed, the person's health would rapidly deteriorate. Similarly, if the support systems propping up the US economy were removed, such as government spending and the Federal Reserve's balance sheet, the economy would likely collapse.

A significant portion of GDP growth came from the inflated government spending funded by more debt, adding 0.8 percentage point to the overall growth. While GDP increased by $414.3 billion between the third quarter of 2022 and the same period in 2023, public debt increased by a staggering $1.3 trillion, reaching $33.6 trillion. Public Debt grew at a ratio of about 3 to 1 vs GDP. This indicates that the United States is experiencing the worst year of growth, excluding public debt accumulation, since the 1930s.

Wrap-Up

While this GDP report exceeded expectations, many economists are predicting a decline in GDP growth in the coming months. The remaining bulk of economic activity is concentrated among wealthier households, while businesses are becoming more cautious. Treasury Secretary Janet Yellen stated that the current data does not indicate any signs of a recession, although she acknowledged that the pace of growth seen in the last quarter is unlikely to be repeated. Federal Reserve Chair Jay Powell also maintains that there is still a path for a soft landing. Many economists still see the odds of a recession next year as 50-50.

Thanks For Reading!

If you want to advertise your business to the 200,000+ readers of this newsletter, learn more here.

To Read Past Newsletters Click here.

To Subscribe Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.