FOMC Raises Rates, Soft Landing is now Expected?

Interest Rates to Highest Level in 22 Years

Rate Hikes: A Precursor to Economic Slowdown or a Necessary Measure Against Inflation?

The recent move by the Federal Reserve pushed its key policy rate above the peak reached just before the 2008 financial crisis, returning it to the highest level in 22 years. However, futures markets imply that this may be the peak for the current cycle, with rate cuts expected by mid-2024.

The central bank has raised its benchmark rate to a range between 5.25% and 5.5%. This has resulted in yields on 3 & 6 month Treasuries reaching about 5.5%, the highest since 2001. Money-market funds, which typically invest in Treasury bills or park cash at the Fed, are offering rates above 5%. Additionally, certificates of deposits (CDs) are offering up to 5.4% for one-year terms.

Historically, the Federal Reserve has often initiated a reduction in borrowing costs between three to 13 months prior to the onset of a recession, indicating that precise timing is pivotal to circumvent economic instability. The potential hazards of indecisive action persist, given that an economy, while appearing robust in terms of activity, can simultaneously exhibit resistance to changes in underlying inflation.

The Fed’s decision to hike interest rates is primarily influenced by the surge in individuals' earning power and its subsequent effect on inflation. Data from the Commerce Department reveals that American households are now earning an additional $121 billion annually from investment income compared to the previous year.

The main point of uncertainty lies in where the slowdown will ultimately stop. The Federal Reserve policymakers have oscillated between predicting a recession during the banking crisis and now suggesting that the slowdown may stop short of a recession. The market, however, continues to indicate that the slowdown will persist and even accelerate.

The Soft Landing Narrative

The term soft landing refers to an economic scenario where growth slows down but avoids a recession. This ideal situation allows for economic stability without the negative impacts of a recession, such as high unemployment and decreased consumer spending. The current consensus is that the US economy appears to be heading towards such a soft landing, with the goal of reducing inflation to the target of 2% without triggering a recession.

Achieving a soft landing is a delicate balancing act for the Federal Reserve. If interest rates are raised too quickly or too high, it could suppress economic growth and trigger a recession. Conversely, if rates aren't raised sufficiently or promptly, it could lead to runaway inflation. Therefore, careful management is required to ensure economic stability while avoiding the pitfalls of both recession and excessive inflation.

Proponents of the soft landing narrative believe that this move will slow down economic activity just enough to prevent overheating but not enough to cause a recession. Critics suggest that instead of engineering a soft landing, the Federal Reserve's decision could tip the economy into a downturn.

Reasons For A Soft Landing

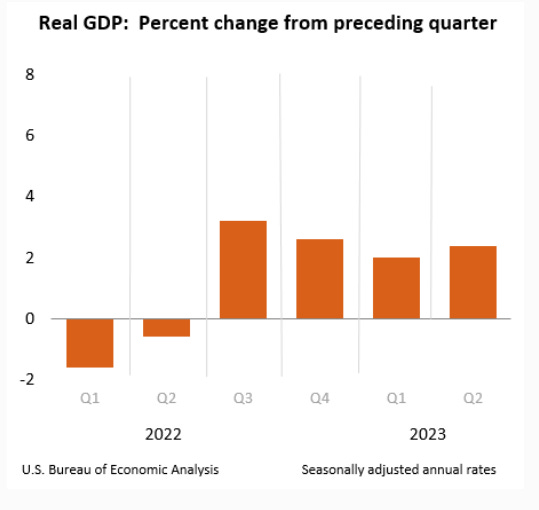

There are several indicators that suggest a soft landing may be possible. The US economy experienced stronger than expected growth with a 2.4% increase in the second quarter, surpassing economists' expectations. As well, job markets have remained strong in developed economies as the unemployment rate remains close to record lows, which is a positive sign for economic stability.

This growth was driven by increased business investment, offsetting slower consumer spending. Additionally, the labor market remains robust, and inflation has been slowing down. Consumer confidence has improved, and the unemployment rate remains close to record lows.

Corporate earnings have been strong, indicating that businesses are performing well despite the higher interest rates. A robust earnings season has helped broaden the market rally, and investors are choosing to focus on the diminishing chances of a recession. In July the S&P 500 index rose by 3% for the month and 19% for the year so far. There have been positive signs in the U.S. economy, such as improving labor costs and unexpected acceleration in economic growth in the second quarter.

The recent rise in stock prices and decrease in bond yields have made it easier for U.S. companies to raise funds, mitigating the impact of the Federal Reserve's interest rate hikes. This improvement in financial conditions is evident in the National Financial Conditions Index, compiled by the Chicago Fed, which has reached its lowest point in 16 months.

Inflation appears to be cooling down. The core personal consumption expenditure (PCE) index, the Federal Reserve's preferred inflation metric, fell to an annual rate of 4.1% in June. The PCE index increased by 0.2% month over month in June compared to the previous month, slightly lower than the 0.3% climb in May. This brings the annual pace of core PCE price growth to its slowest since September 2021 when prices were rising at a 3.9% annual rate.

While interest rates have increased, many individuals have not experienced a significant increase in costs because they have financial assets that are benefiting from the elevated interest rates. The easing of monetary policy during the pandemic helped many Americans reduce their debt burden, enabling them to refinance or take out low-rate loans. With wages rising and Covid-19 stimulus measures still in effect, the average household's net worth has rebounded to near-record levels. The pandemic response has shielded many Americans from rising interest rates.

Reasons Against A Soft Landing

Historically, strong GDP growth has often preceded a recession. In 2000 and 2007, GDP growth exceeded expectations shortly before a recession began. As well, historical patterns show that high inflation and the need to disinflate through raising interest rates have often resulted in recessions. Furthermore, there is concern about the lag time between monetary policy changes and their impact on the real economy, which is generally believed to be 12-18 months.

Even though the latest GDP report for the United States showed unexpected strength and resilience with a quarter-over-quarter growth rate of 2.39%, nominal spending and economic activity have slowed down significantly. Nominal GDP increased at a rate of only 4.7% in the second quarter of 2023, compared to higher rates in previous quarters.

While the stock market year to date has experienced a great bull run, more than 51% of S&P 500 companies have already reported their quarterly financial results, and earnings are on track to decline by 7.3% compared to last year.

It's imperative to bear in mind that the core PCE inflation rate currently stands at more than twice its target, implying a likelihood of future rate increases. This expectation appears to be mirrored in the bond market, where bond yields experienced an uptick last week. Powell acknowledges that stronger growth could eventually lead to higher inflation, necessitating an appropriate response from monetary policy.

The swift depletion of substantial savings, amassed by numerous households throughout the COVID-19 pandemic due to lockdown measures and government stimulus initiatives, is a growing concern. This trend could precipitate a decline in consumer spending, potentially instigating a cycle of diminishing business investment. Furthermore, the current monetary policy is sufficiently restrictive, a fact underscored by lackluster retail sales data. This implies that surging living costs are adversely affecting private consumption, potentially paving the way for an economic slowdown.

Despite the weakening economy, companies have been strategically retaining their employees, anticipating an economic rebound in the latter half of the year. This approach is based on the expectation of a market recovery, which if not realized, could lead to a mass layoff, triggering a sudden surge in unemployment rates. Presently, we are observing a trend of disinflation as a result of the economic slowdown, coupled with deflation triggered by decreased sales and inventory cycles.

The Yield Curve as an Economic Indicator

The yield curve, which measures the difference between short-term and long-term interest rates, has been a point of contention in discussions about the Federal Reserve's decision. In 2019, when the yield curve was flat, it was seen as a sign of economic weakness. However, despite a positive outlook on the economy today, the yield curve remains relatively flat. This suggests that market participants may not share the Federal Reserve's optimism about future growth and inflation. Critics argue that the Federal Reserve tends to embrace the yield curve when it supports their views but ignores it when it contradicts their narrative.

Wrap UP & Poll

The Federal Reserve's decision to raise interest rates is an important step towards controlling inflation and stabilizing the economy. However, achieving a soft landing will require careful policy-making and some degree of luck. The Federal Reserve's decision to raise its benchmark interest rate by a quarter of a percentage point to the highest level in 22 years marks a significant shift in monetary policy. The FOMC unanimously supported this decision, indicating a collective belief in the necessity of this action. The resilience of businesses, the gradual recovery of various sectors, and improved consumer sentiment all contribute to a more optimistic view of the future. However, there is real concern about the lag time between monetary policy changes and their impact on the real economy, the decrease in American savings and the drop in earnings for most S&P 500 companies.

For more analysis on these topics, check out these articles:

Federal Reserve raises US interest rates to highest level in 22 years

Confidence grows that Federal Reserve can deliver a soft landing for US economy

AI Mentions on the Rise in Tech Earnings Calls as Recession Talk Fades

For the stock market, bad news is back to being good. Heres why, says a Goldman Sachs economist

RBA Watchers Split as Policy Tightening Cycle Is Nearing End

New Risks Shadow Bond Market as Feds Rate-Hike Cycle Nears End

Fed no longer foresees a U.S. recession and other things we learned from Powells press conference

Central banks leave investors in the dark as they near peak rates

U.S. stocks hold ground as Wall Street eyes 5-month winning streak

Charting the Global Economy: Fed, ECB Press on With Rate Hikes

Vanguards Economists Arent Buying Talk of a Soft Landing: Q&A

GDP Growth Was Hot. Consumer Spending Was Cooler, and Thats a Problem.

Bernanke Tapped to Find Out Why U.K. Central Bank Misjudged Inflation

Booming markets neutralise impact of rate rises on US corporate fundraising

U.S. Economic Growth Accelerates, Defying Slowdown Expectations

Bank of Japan bond yields surge to 9-year high after monetary policy change

Fed lifts rates, Powell leaves door open to another hike in September

Dwindling excess savings could scupper markets' soft-landing hopes

The Feds Preferred Inflation Metric Falls Again, to 4.1% Annual Rate

Last hike of the cycle: economists predict Federal Reserve is done with interest rate rises

Endgame for Fed's tightening cycle challenged by easing financial conditions

What Fed Hikes? Much of Americans Debt Is Still Riding Ultralow Rates

Most Economists See One More ECB Hike But Some Arent Sure When

Market and Fed Finally Agree on the Economy. What If Theyre Both Wrong?

Stocks Are Doing So Well That It May Be Time to Start Worrying

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.