October CPI. Why Are We Ignoring the Health Insurance CPI changes?

Fed Rate Hike Cycle Is Done

The Consumer Price Index (CPI) is a critical economic indicator that measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The CPI is used to assess price changes associated with the cost of living and is one of the most frequently used statistics for identifying periods of inflation or deflation.

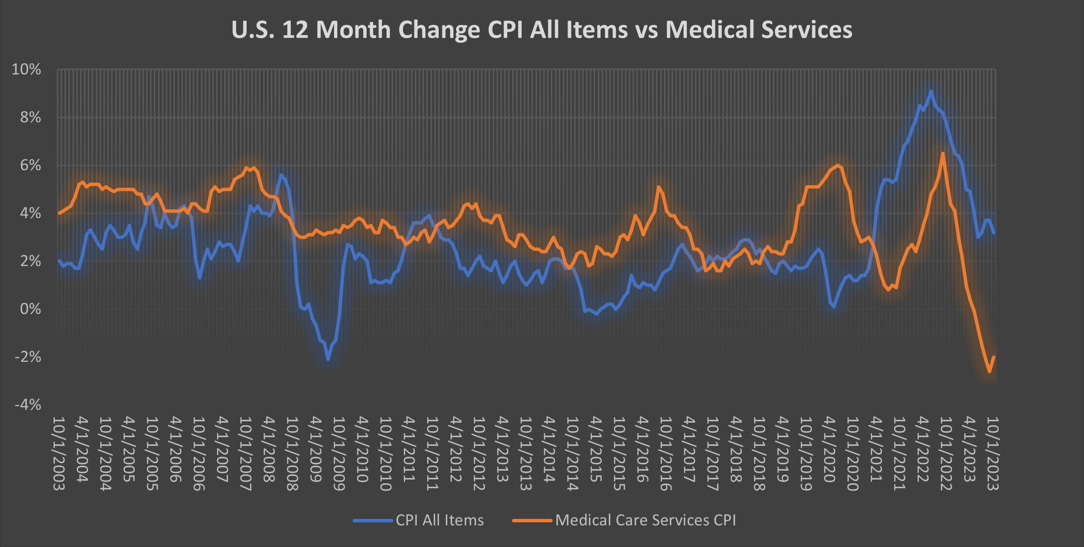

On a year-over-year basis, the CPI decelerated to 3.2% after three consecutive months of re-acceleration. This is slowdown from the 3.7% rate recorded in both September and August. The year-over-year core CPI rose by 4.0%. This deceleration can be attributed to a 5.5% month-to-month plunge in energy prices, a drop in durable goods prices and a significant 34% plunge in the health insurance CPI. The price of regular unleaded gasoline fell from $3.81 at the start of the month to $3.46 a gallon at the end.

We'd like to emphasize that most publications are neglecting to address the significant decline in health insurance Consumer Price Index (CPI), opting instead to focus solely on the drop in energy and durable goods prices. More on this later.

Energy prices have experienced a significant plunge, while durable goods prices, including cars, electronics, and furniture, have dropped as well. On the other hand, food prices have risen moderately, with some food items experiencing a decrease in prices while meat prices have seen a notable increase. The cost of auto insurance has risen with a 1.9% increase from September to October and a nearly 20% surge compared to the previous year.

The decrease in goods prices was primarily driven by a significant drop in gasoline costs. Services costs remained flat after six consecutive months of growth. Despite elevated labor and input costs, annual producer price growth has eased since early 2022 due to supply chains normalizing and a shift in consumer spending towards services.

Shelter and shelter inflation remain higher than historic levels. The BLS does not measure the cost of homeownership based on home prices. Instead, it estimates the cost of renting a home equivalent to what a homeowner would pay. This measure, known as owners' equivalent rent, tends to track rental prices rather than actual home prices. Since the start of 2021, owners' equivalent rent has increased by 17%.

Contrary to popular belief, wage inflation has not been a significant contributor to overall inflation. The share of wage compensation in overall business income has actually declined over the years, further decreasing to 55% during the pandemic cycle. If wage inflation were real, we would have seen the opposite trend.

Health Insurance CPI

The healthcare sector has experienced significant adjustments to the health insurance CPI over the past year, resulting in distorted data. These adjustments began in October 2022 and continued for 12 months until September 2023. The adjustments caused the CPI, core CPI, and core Services CPI to be downward-distorted, leading to a decrease in the health insurance CPI.

Despite the actual increase in health insurance expenses, the CPI reflected a 37% collapse in the health insurance CPI over the 12-month period. In October 2023, there was a 1.1% increase in the health insurance CPI. This increase followed 12 consecutive months of significant decreases, averaging around 4% per month. The year-over-year change in the health insurance CPI remained distorted due to the base being knocked back to August 2018 levels.

Consumer Sentiment

While specific prices are not factored into the University of Michigan's index, a growing number of respondents have been spontaneously mentioning food or gas prices during interviews. These individuals tend to have lower sentiment compared to those who do not mention these items. This aligns with anecdotal evidence that suggests consumers are feeling the impact of rising grocery and gasoline costs. Since January 2021, gasoline prices have risen by 43%, while food prices have increased by 20%.

Federal Reserve Reaction

The Fed's goal is to achieve a "soft landing," where inflation is lowered to around its 2% target without triggering a recession. The recent cautious tone of the Fed, coupled with weak job reports and lagging effects of monetary policy tightening, suggests that the current policy cycle has ended its rate-hiking phase. Traders have almost entirely ruled out potential Federal Reserve rate hikes. The market is now predicting that rates will remain the same, with no increases or decreases expected in the near future.

The decline in inflation rates across advanced economies has raised expectations that central banks may shift their focus from tightening monetary policy to cutting interest rates next year. This would provide much-needed relief to the struggling global economy, especially outside the US, and increase the likelihood of a soft landing without significant increases in unemployment.

The prevailing narrative, like above, suggests that rate cuts will lead to a soft landing, but historical evidence paints a different picture. Past instances of rate cuts have often coincided with downturns in the economy. In fact, each cycle of rate hikes followed by rate cuts has ultimately resulted in a recession, despite the optimistic notions of a "soft landing" or even no landing at all. The accompanying graph should provide a clear visual representation of this trend.

Market Reaction

Following the release of October's CPI data, stock prices experienced a 1.1% gain in futures on the S&P 500. Despite the decline in overall consumer prices, the stock and bond markets reacted positively, with many investors and economists hopeful that this soft inflation data would lead to a year-end rally. The yield on the 10-year Treasury note dropped below 4.5% after nearly reaching 5% the previous month.

The market's reaction to the inflation report was positive for the banking sector. Bank stocks experienced their best day in almost two years. The SPDR S&P Bank ETF (ticker: KBE) saw a 6.5% increase in midday trading, just slightly behind the 6.9% increase seen on January 6, 2021.

Thanks For Reading!

If you want to advertise your business to the 200,000+ readers of this newsletter, learn more here.

To Subscribe Click here.

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.