Climbing US Housing Prices Coupled With Higher Rates and Reduced Supply

AirBNB Effectively Banned in NYC

The Housing Market

The U.S. housing market is currently experiencing a unique situation characterized by rising mortgage rates, increasing house prices and constrained housing supply & demand. The scarcity of available homes, coupled with the lock-in effect caused by high mortgage rates, has created a situation where homeowners are reluctant to sell their properties. As a result, existing home inventory is at a record low, further exacerbating the supply-demand imbalance.

Before Article Market Predictions:

This supply-demand imbalance in the housing market could potentially force the Federal Reserve to maintain higher interest rates for a longer period. The increase in mortgage rates has significantly reduced housing demand, with mortgage borrowing as a share of GDP shrinking by 3% in the first 15 months of the rate increase cycle. This decrease is the largest on record during this early stage of a rate hike.

The shortage of housing units is estimated to be around 3-5 million units below demand, and the current rate of construction, at approximately 1.5 million units per year, is insufficient to bridge this gap. This shortage is contributing to the continued rise in house prices despite the pressure that expensive mortgages put on demand.

Federal Reserve Rate Hikes

Federal Reserve policy makers have been unanimous in their preference for raising interest rates too much rather than too little, due to concerns about persistently high inflation. Fed officials have raised rates at 11 of their past 12 meetings, most recently in July. There is now a shift in this stance, with some officials seeing the risks as more balanced. They are worried that raising rates could lead to an unnecessary downturn or trigger financial turmoil. It is expected that they will hold interest rates at this level at their upcoming meeting in September, giving them more time to assess the impact of previous increases.

Another factor influencing the decision is the recent increase in yields on the 10-year U.S. Treasury note, which has raised borrowing costs, including mortgage rates. This increase in borrowing costs has had a similar effect to a Fed rate hike, leading some officials to question the necessity of further increases.

Prices, Mortgage Applications, & Affordability

The U.S. housing market has experienced a surprising recovery, with home prices rising in July after five consecutive months of decline. One of the main factors contributing to this recovery is the scarcity of homes for sale. Black Knight's Home Price Index reveals that home prices reached an all-time high in July, with a 2.3% increase from the previous year. In June, home prices had only risen by 0.9% on a yearly basis. If the current pace of price gains continues, annual gains could surpass 7.5% by the end of the year. The median price of an existing home in July was $406,700, while the price of a newly built home was $436,700.

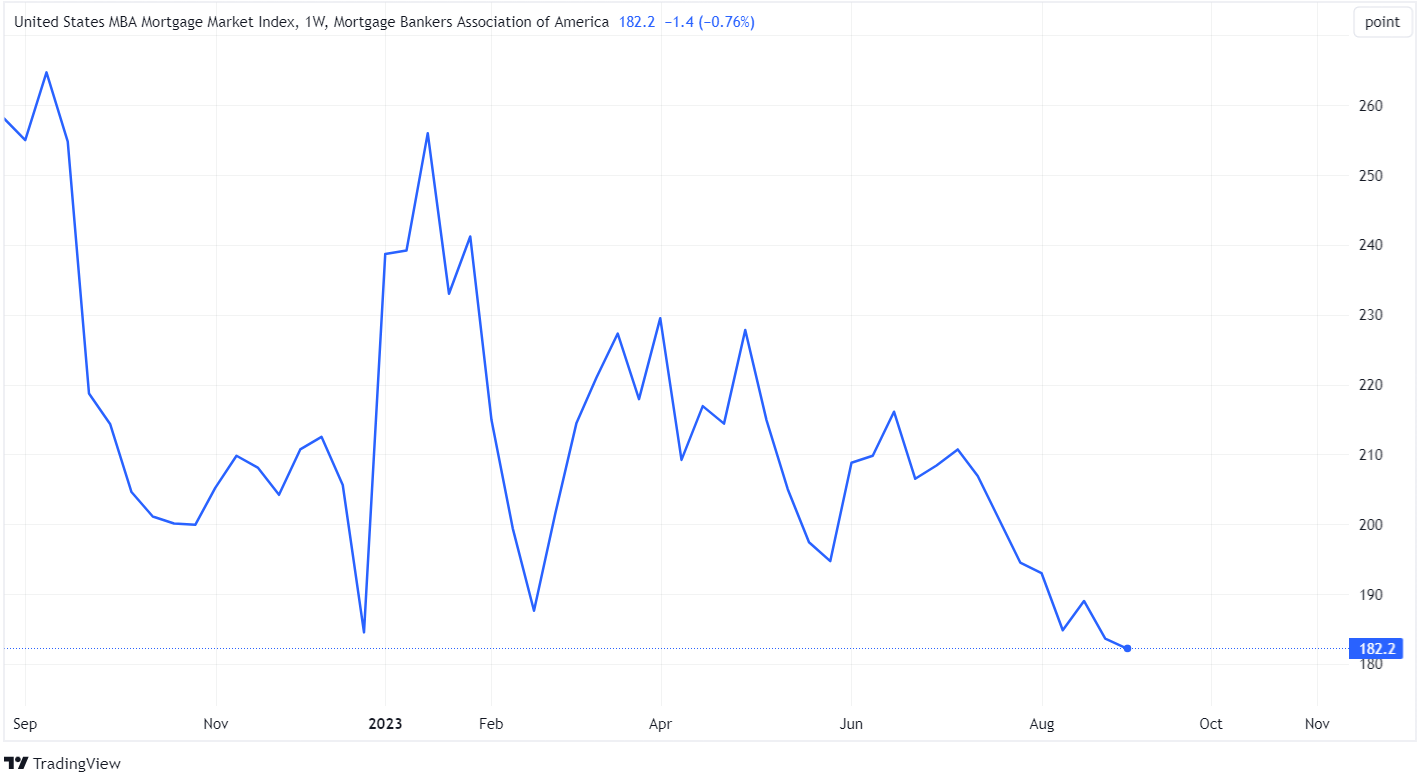

High interest rates have discouraged homeowners from buying new properties and taking on more expensive mortgages, resulting in a significantly low inventory of available homes. The surge in interest rates has led to a decline in the volume of applications for home purchase loans, as measured by the Mortgage Bankers Association's index. This index has reached its lowest level in 28 years, indicating that prospective buyers are hesitant to enter the market due to low housing inventory and elevated mortgage rates. The MBA market composite index currently sits at 182.2, which is a significantly than the index's value of 258.1 a year ago. Despite these challenges, homeowners continue to enjoy significant wealth gains from rising home prices, with the measure of accessible equity increasing to $10.5 trillion in June.

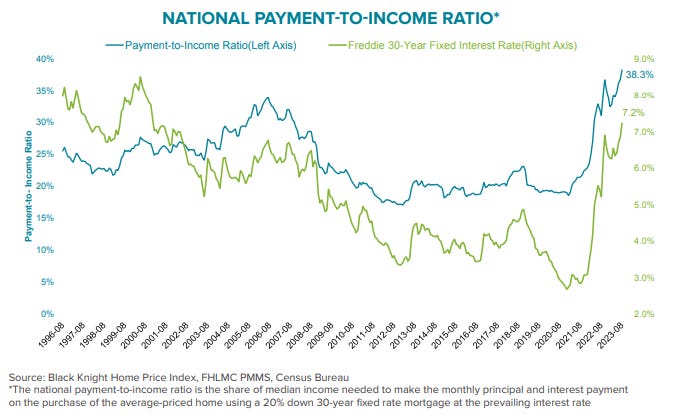

According to mortgage-data company Black Knight, housing affordability has fallen sharply to its lowest level since 1984. In July, the monthly payment on a typical home required approximately 38% of a median household's income, up from 36.8% the previous month. This makes housing the least affordable it has been since 1984. In comparison, housing was most affordable in January 2013, with a payment-to-income ratio of just 17.1%. However, this was also shortly after the Great Recession when the housing market hit its bottom. At that time, mortgage rates were considerably higher at 13.2%.

Black Knight's data shows that the cost of purchasing a median-priced home with a 20% down payment and a 30-year fixed-rate mortgage has risen by 91% over the past two years. As of August 24, mortgage rates stood at 7.23%, resulting in a typical monthly mortgage payment of $2,423.

The inventory of homes for sale remained constrained in nearly all districts, leading to increased construction activity for single-family housing. New home sales, based on contract signings, increased in July to the highest level since February 2022. Builders have been able to offer incentives such as mortgage rate buy-downs, which have tipped the scales in favor of new construction.

Home building stocks have outperformed the broader market between the end of September and the end of January. The SPDR S&P Homebuilders ETF, which includes top holdings like PulteGroup and Toll Brothers, has seen an average gain of 6.3% during this period, compared to the broader S&P 500's average gain of 3.4%.

Short Term Rentals “Banned”

In the housing market, a recent survey conducted by Realtor.com and CensusWide revealed that a majority of homeowners would consider renting out their homes on a short-term basis instead of selling them in the current market. This trend can be attributed to high 30-year mortgage rates, which are currently over 7%.

With homeowners locked into low rates, they will turn to platforms like Airbnb. These platforms influence the housing market by reducing the number of properties available for long-term rental or purchase, thereby affecting housing supply and prices. Additionally, the success of Airbnb can also encourage real estate investors to purchase properties for short-term rental purposes, further impacting the housing market.

Recently, New York City has passed a new regulations that requires all short-term rental hosts to be registered with the city, live in the place they are renting, be present when renters are staying, and have a maximum of two guests. These regulations have sparked controversy and raised concerns about their impact on the city's tourism economy and the housing market. There are currently over 40,000 Airbnb listings in New York City alone, but only 22,434 of these are categorized as short-term rentals. These regulations could have a significant impact on the housing market as they could lead to a surge of distressed properties hitting the market which would drive down prices. Many of these property owners may now face negative cash flow as a result of the new regulations, forcing them to convert their properties into long-term rentals or sell their properties altogether.

Homeownership has long been an integral part of the American dream, prompting politicians to face mounting pressure to enact legislation that enable makes homeownership affordable for more Americans. Theoretically, reducing the ability to offer housing as short term rentals will increase the housing supply and could subsequently lead to a decrease in housing prices. Recent regulations implemented in New York City may set a precedent for similar regulations to be adopted in other cities, aiming to curb the utilization of housing for short-term rentals.

Rental Prices & Housing Shifts

The rise in interest rates and home prices has also led to a surge in rental prices in suburban areas. Many white-collar workers with remote jobs moved out of city apartments during the early months of the pandemic in 2020, seeking more spacious accommodations. Now, high mortgage rates and home prices are preventing some of these families from purchasing homes, leading them to rent for longer periods. Rents in suburbs have increased by 26% since March 2020, surpassing the 8% gain in urban cores. This trend is observed in 28 out of the 33 metro areas studied. Single-family home rents are growing in most parts of the country, with real estate research firm Green Street predicting that single-family home rental landlords will achieve the highest returns among all real estate owners this year.

The rental housing market is also facing increased scrutiny as landlords impose a multitude of fees on tenants. These fees, which can quickly add up to hundreds of dollars per year, include charges for trash pickup, pest control, mailbox usage, and even routine maintenance requests. Large property-investment companies continue to introduce these additional fees to boost their profits.

In response to these concerns, the federal government and some states are cracking down on how landlords charge fees. Major listing platforms, such as Zillow and Apartments.com, are now required to disclose all fees and their costs alongside listings.

After Article Market Predictions:

For more analysis on these topics, check out these articles:

Whats Worse Than Record High Rent? Record High Rent, Plus Fees.

U.S. mortgage demand drops to the lowest level in 27 years, despite drop in rates

Homeowners Are Sitting on Piles of Equity. Why Theyre Not Tapping It.

Housing affordability is now at its worst level since 1984, Black Knight says

The Housing Market Is Approaching Its Slow Season. Why Home Builder Stocks Might Not Be.

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.