The Labor Market: Strong Performance, Subject to Revision

Labor Market Revisions Show Downward Trend.

Understanding the Current State of the U.S. Labor Market

The U.S. economy is showing signs of slowing down, with job openings decreasing and job growth slowing. Despite this, the labor market continues to experience a worker shortage, contributing to high wage growth and inflationary pressure. Meanwhile, the U.S. manufacturing index contracted for the tenth consecutive month. Additionally, a surge in credit card debt and delinquency rates is causing concern, particularly among consumers. Despite these challenges, U.S. stocks have seen strong weekly gains, and the dollar index has risen.

Before Article Market Predictions:

Trended predictions from previous articles are now at the bottom of the article.

Labor Market

The current state of the U.S. economy suggests that it is cooling down, as job openings are decreasing and job growth is slowing. The August non-farm payrolls report revealed that the US economy added 187,000 jobs, surpassing economists' expectations of 170,000. However, the payrolls for June and July were revised lower by a combined 110,000. This brings the cumulative total to 405,000 jobs that have been revised lower for the year of 2023. It seems that the BLS needs to adjust the trend for which they estimate jobs. Many sources are bullish on the 187,000 jobs added for August, but at this point it is better to react to revisions.

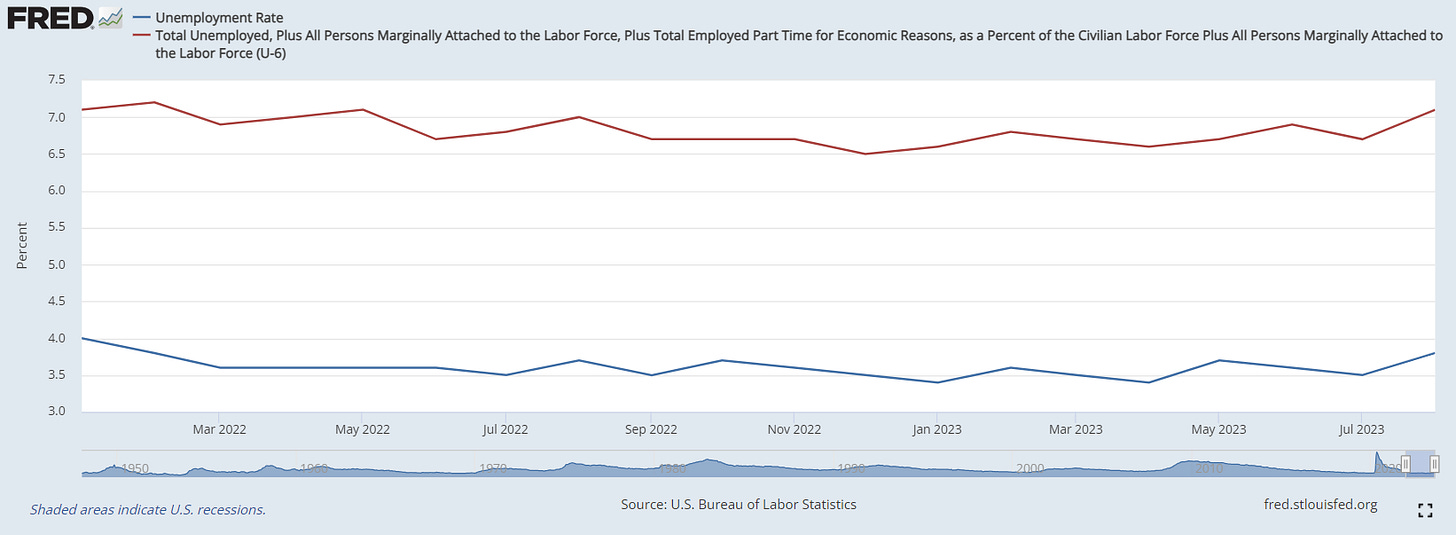

The unemployment rate (U3) rose to 3.8%, exceeding economists' forecasts of it remaining steady at 3.5%. The U6 unemployment rate, which includes discouraged workers and those working part-time for economic reasons, has increased to 7.1%. This suggests that the U6 rate may be leading the U3 rate, indicating potential weakness in the labor market. The share of people working or actively seeking employment climbed to 62.8%, reaching its highest level since early 2020. This increase in labor force participation partly explains the sharp rise in the unemployment rate.

Another indicator for recession may be close to being signaled. According to the Sahm Rule, developed by a former Fed economist, a .5% increase in the 3-month rolling average of the unemployment rate from its low point of the previous year indicates an economic recession or contraction. As of August, the 3-month rolling average was 3.6%, and if the current unemployment rate of 3.8% holds for two more months, the Sahm Rule would be triggered (indicating we are in recession).

Despite the labor market's recent slowdown, a severe worker shortage persists, maintaining high wage growth and contributing to inflationary pressure. The average workweek has extended to 34.4 hours, while temporary employment has seen a decline. Should this trend persist, it could exert further upward pressure on wages, as full-time employees may need to compensate for the shortfall. This scenario could potentially trigger the Federal Reserve to implement a tighter monetary policy if average earnings witness a substantial increase.

U.S. Manufacturing Index

The latest reading from the U.S. ISM manufacturing index (PMI) reveals that while new orders slipped, prices paid rose. The index rose more than expected in August to stand at 47.6, indicating contraction for the tenth consecutive month. The PMI uses a scale of 0 to 100, where a reading below 50 indicates contraction and above 50 indicates expansion.

Credit Card Debt & Delinquency Rates

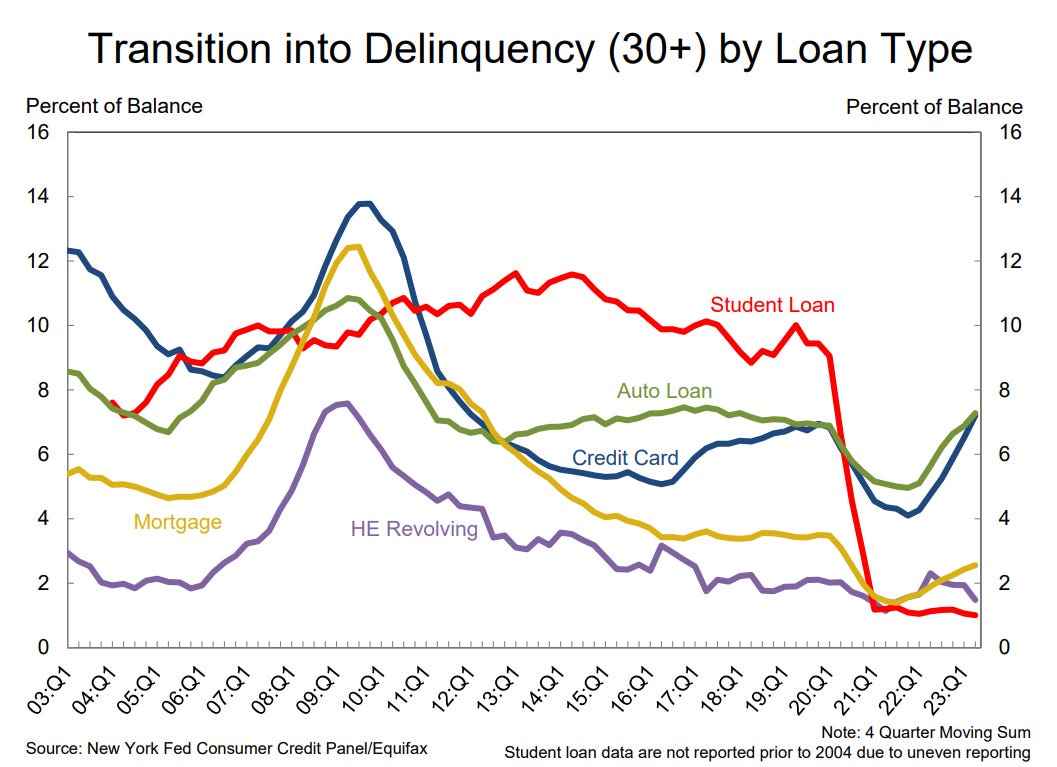

The recent surge in credit-card debt, coupled with an increase in delinquencies, is a cause for concern. While some individuals are able to manage their credit-card bills effectively, many others are struggling with high levels of debt and rising interest rates. Lenders are tightening their lending standards, which disproportionately affects subprime consumers.

Credit-card delinquency rates have been increasing across four generations of borrowers. This is the percentage of loans within a loan portfolio that have overdue payments. According to new data from VantageScore, these delinquency rates reached a new high in August. Borrowers with a VantageScore between 300 and 600 experienced an 8.9% delinquency rate of 30 to 59 days in July 2023, up from 7.49% the previous year.

Additional data from the Federal Reserve Bank supports these findings. Credit-card delinquency rates at smaller banks reached a record high of 7.51% in the second quarter of 2023, compared to 6.01% during the same period last year. In contrast, the delinquency rate at the top 100 banks was lower at 2.63% in the second quarter, compared to 1.71% a year ago.

The rise in credit-card delinquencies comes at a challenging time for consumers, particularly low-income Americans. Student-loan repayments are set to resume after the pandemic-era moratorium, and interest rates are at a 22-year high.

Labor Report Reactions

The release of the jobs data led to a decrease in yields on US government debt, with the yield on the two-year Treasury rising to 4.88% and the yield on the 10-year Treasury rising to 4.18%. U.S. stocks ended Friday mostly higher, with strong weekly gains. The S&P 500 is up 17.6% for the year, the Dow Jones Industrial Average is 5.1% higher, and the Nasdaq Composite Index has advanced 34.1% so far in 2023. The dollar index, which measures the strength of the currency against a basket of peers, gained 0.6%.

Economists predict that global growth will slow down in 2024 due to persistently higher interest rates in major economies. The consultancy Consensus Economics predicts that output will expand by 2.1% in 2024, down from the expected 2.4% growth this year.

After Article Market Predictions:

Subscriber S&P500 Index Predictions:

For more analysis on these topics, check out these articles:

August Jobs Report Shows Labor Markets Cooling. That May Persuade the Fed to Pause.

Why Consumer Confidence Is Dropping When the Economy Looks So Strong

U.S. recession chances lowered by Goldman Sachs for the third time in four months

US jobs data raises hope of Goldilocks scenario as economy cools

Cooling US economy gives Fed breathing room on interest rates

Economists grow gloomier on 2024 as central banks delay rate cuts

Stocks and bonds are out of balance. Heres what could come next.

U.S. adds 187,000 jobs in August. Slower hiring could help in fight vs. inflation.

Three Reasons Why the U.S. Economy Remains Surprisingly Resilient

Construction Spending for Factories Soars, after Decades in the Doldrums

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.