The Surprising Disconnect: Fed Interest Rates vs US Treasury Yields

Bond Markets Signal Inflation Being Crushed

Inflation & Fed Interest Rates

The path of inflation remains uncertain, with some economists predicting that underlying prices from the Federal Reserve's preferred inflation measure will remain stubborn through 2024, keeping interest rates higher. However, others anticipate that inflation will slow more quickly than Federal Reserve officials expect. This slowdown is expected to occur not only in the US but also across the eurozone, the UK, and other major developed markets. As a result, central banks across advanced economies are likely to loosen policy, with the Federal Reserve expected to lead the global easing cycle.

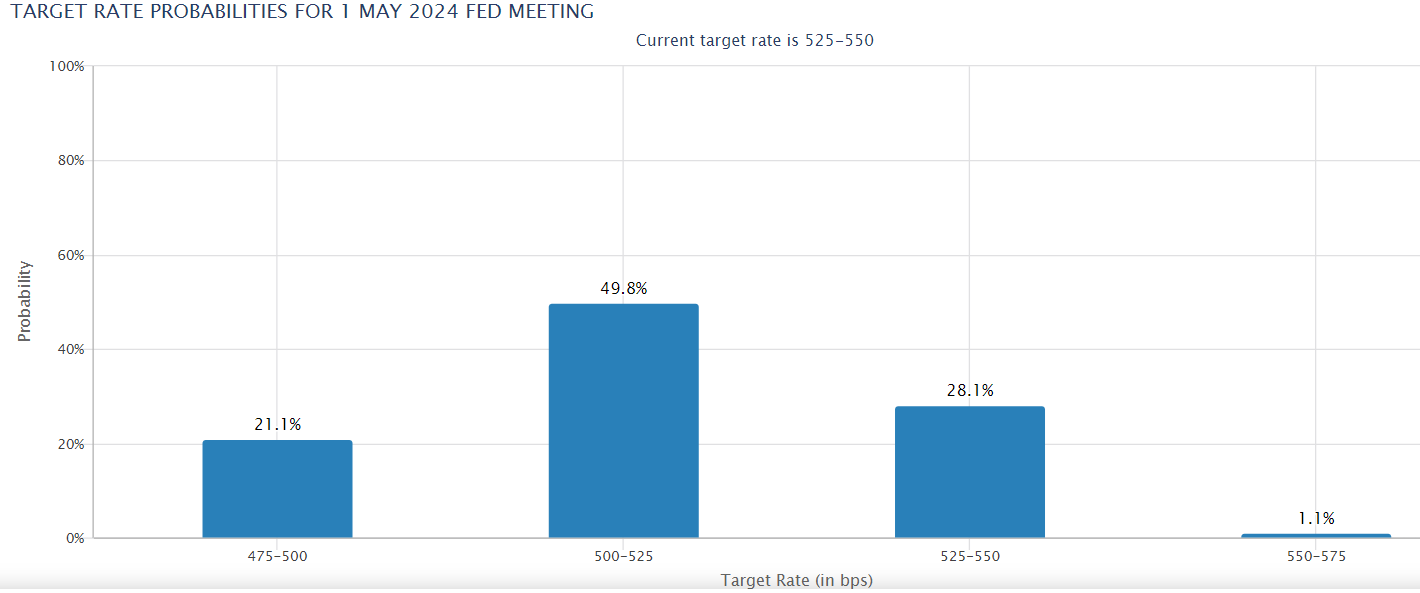

Investors are pricing out any prospect of further rate rises due to a decrease in October to 3.2%. The odds that Fed officials will choose not to raise rates after the next two-day meeting of the Federal Open Market Committee (FOMC) increased to 94.1%. Interest-rate futures indicate a roughly 70% chance that the Federal Reserve will lower rates by a quarter-of-a-percentage point by its May 2024 policy meeting. This is a significant increase from a 29% chance at the end of October.

The same data points to four cuts by the end of the year. As well, Interest-rate futures indicate a 99.9% chance of interest rate cuts occurring in 2024.

Deutsche Bank analysts forecast that the Federal Reserve will cut rates by 175 basis points in 2024 in response to a mild recession. This would drive the Federal Reserve funds rate down to between 3.5% and 3.75%. This loosening monetary policy would, by definition, create more inflation.

U.S. Treasuries

The bond market is expected to rally in response to soft growth, falling inflation, and lower interest rates. This expectation is supported by recent market trends where traders returned from the Thanksgiving holiday to find markets continuing to cling to the view of a soft landing. This resulted in rates on 3-month Treasury bills through the 30-year bond moving lower amid broad-based buying of government debt.

Traditional big buyers, including China, have reduced their appetite for Treasuries. However, Goldman Sachs Group Inc. analysis suggests that these numbers may be overstated due to current valuations and dropping Treasury prices as yields have climbed in recent years. Some countries have also been selling off their holdings to support their depreciating exchange rates. Overseas investors have gone from holding 43% of U.S. debt a decade ago to holding just 30%. This is concerning as government issuance is massively expanding and firms face a 2025 refinancing cliff.

The U.S. government is borrowing significantly more, and politicians are not inclined to spend less or raise taxes. This increases the annual additions to the supply of Treasuries. As the share of retirees in the population increases, they sell bonds and stocks to finance spending. This too reduces demand for bonds. More supply and less demand mean higher interest rates on Treasuries.

The U.S. Dollar

The strength of the US dollar has been instrumental in fighting inflation over the last year. As the dollar rose, commodity prices dropped, driving the Consumer Price Index (CPI) lower. The US dollar is experiencing a shift as foreign central banks and other investors are diversifying away from it. The diversification away from the dollar is likely due to a combination of factors, including the increasing borrowing by the U.S. government and the shifting demographics of retirees. Asset managers are on track to sell 1.6% of their open dollar positions this month, the largest monthly outflow since last November. This has helped put the greenback on course for its worst monthly performance in a year.

Breaking This Down

Interest rates are being projected to be cut, this should in theory stimulate the economy and push inflation upward. Such a scenario is generally bearish for treasuries, likely resulting in an increase in yields. The underlying rationale is that if investors anticipate a depreciation in the dollar's value, they would be disinclined to hold long-term treasuries. Consequently, they would sell these assets, an action that typically contributes to pushing yields upward.

Overseas investors are offloading their bonds in an effort to stabilize their exchange rates, a move that typically exerts a bearish influence on treasuries and is expected to drive yields upward due to the surge in bond selling. Concurrently, the government's accelerated pace of debt issuance is adding to the upward pressure on yields. Additionally, the shift of central banks away from the U.S. dollar and the so called weakening of the U.S. dollar should further push yields higher.

The Disconnect

Despite multiple factors seemingly poised to drive treasury yields upwards, we are observing an unexpected decline in these yields. This trend suggests deflationary tendencies in the economy and an increasing likelihood of an economic recession. The prevalent discourse emphasizes parallels to the inflation of the 1970s and concerns about the U.S. dollar losing its status as the world's reserve currency. Under these assumptions, a rapid rise in yields would be anticipated. Logically, yields should at least exceed the Federal Funds Rate across the entire yield curve. Contrary to these expectations, however, the yield on the 10-year Treasury note remains at 4.3%.

Thanks For Reading!

If you want to advertise your business to the 200,000+ readers of this newsletter, learn more here.

To Subscribe Click here.

To Read Past Newsletters Click here.

If you have any source you wish to see in our lineup, please reach out and let us know. We continually look to incorporate more independent sources to our weekly wrap-up.