Oil Prices Explode

Saudi Arabia Continues to cut supply

The global oil market is currently experiencing a dynamic shift, with crude oil futures and premiums for physical barrels surging worldwide. Brent crude, the oil price benchmark, reached a 10-month high of nearly $94 a barrel last week, up from its lowest point of $72 a barrel in June. This represents the largest quarterly increase since Russia's invasion of Ukraine. Similarly, West Texas Intermediate, the lighter US crude, has seen a significant climb from $67 a barrel to $90 a barrel over the same period. Both benchmarks have experienced a 4% increase in the past week.

Before Article Market Predictions:

Oil price surge

The rise in oil prices can be attributed to several factors. Production cuts by Saudi Arabia and Russia have tightened supplies while consumption has reached record levels. This has led to a depletion of stockpiles and forced refiners to purchase more barrels to produce the necessary fuels. This can be seen in the oil futures curve, with the nearest Brent futures contract trading at a premium to the next month. This structure, known as backwardation, indicates scarce supply and is at its highest level since November

Strong profits from turning crude into diesel have led processors to pay high premiums for grades that produce a significant amount of this fuel. This is evident in the surging physical markets, with Azerbaijani crude trading close to $100 a barrel and once-discounted Russian barrels now trading above their benchmark in Asia due to favorable profit margins.

There is an expectation of a progressive loosening of the market in the future driven in part by increased supply from countries outside the OPEC+ alliance, such as the United States, Guyana, and Brazil.

Many analysts predict that oil prices will continue to rise due to the production cuts limiting supply while global demand accelerates. Mike Wirth, CEO of US energy major Chevron, also predicted that oil prices would soon surpass $100 a barrel. The International Energy Agency (IEA) expects global oil consumption to reach a new record of 101.8 million barrels per day this year, driven by increased Chinese demand.

Supply Cuts

Saudi Arabia's announcement of the production cuts extension, made in collaboration with Russia, has already led to a more than 5% increase in Brent crude, the international oil benchmark. The energy minister, Prince Abdulaziz, emphasized that the decision to extend the production cuts is not about raising prices but rather about making the right choices based on available data. He expressed uncertainty about the global economic recovery and its impact on oil demand. Saudi Arabia's attempts to increase oil prices to fund government spending could inadvertently lead to a decrease in demand if prices rise too high. This delicate balancing act underscores the complexity of managing oil prices in a rapidly evolving energy landscape.

The alliance between Saudi Arabia and Russia, which has effectively reduced oil supply by 1.3 million barrels per day. This reduction is expected to continue until the end of the year, posing a formidable challenge for oil markets. The production cuts have driven crude oil prices to their highest levels in 10 months, allowing refiners to charge higher premiums for producing heavy fuels used in trucks, planes, and ships. In the first 13 days of the month, Russian oil companies exported approximately 63,000 tons of diesel per day, which is a 31% decrease compared to the average for the first 30 days of August. Additionally, producers have redirected more fuel to the domestic market following government efforts to ease prices.

Furthermore, Russian refineries are currently undergoing seasonal maintenance, which is expected to peak between the second half of September and mid-October. As a result, diesel output has fallen by 5.5% to approximately 234,000 tons per day in the first 13 days of September. Diesel retail prices as of September have risen by over 7.3% since the beginning of the year, according to data from the Federal Statistical Service.

Shifting Demand

The International Energy Agency (IEA) predicts that the demand for fossil fuels, including oil, coal, and natural gas, will peak this decade, marking a potential end to the fossil fuel era. This projection is based on the rapid growth of renewable energy sources and the increasing adoption of electric vehicles.

As global energy companies, financiers, and governments increasingly move away from fossil fuel investments due to environmental concerns, the demand for products like jet fuel and gasoline continues to grow, especially in emerging economies. This situation creates a mismatch between the decreasing oil processing capacity and the rising demand, leading to more volatile prices and potential supply disruptions.

According to industry consultant FGE, oil demand growth has been outpacing the increase in refinery capacity since 2021, and this trend is expected to continue until 2027. After that, there are no confirmed new refinery projects, although there may be some undertaken in Asia and the Middle East

.

Underinvestment & Constrained Refineries

One of the most pressing challenges in the global oil market is underinvestment. According to JP Morgan, there is a chronic underinvestment in the oil and gas industry, exceeding $600 billion per year. Despite rising oil prices, companies worldwide have continued to reduce investment in exploration and production. This lack of investment has persisted for six consecutive years, with total investment falling below depreciation.

Moreover, governments and financial institutions worldwide have declared war on investment in fossil fuels under the misguided belief that supply and prices would remain unaffected. This ideological imposition has led to an exceedingly negative scenario where developed economies have destroyed incentives to invest in diversification and security of oil and gas supply, making their economies more reliant on foreign suppliers.

The refining system is already under strain due to closures of older plants in Europe and the US, driven by environmental concerns. Major global companies have also reduced their smaller operations. Instead, refining investment has been led by regions like Asia, the Middle East, Africa, and Latin America. However, even in China, which used to be a net fuel exporter, there is little spare capacity to meet the strong demand.

Refineries worldwide are currently running at near-record high utilization rates. According to estimates by Parsley Ong, head of Asian energy and chemicals at JPMorgan Chase & Co., global refining capacity will increase by 1.9 million barrels per day this year, but shutdowns will amount to 600,000 barrels per day. By 2025, Ong expects a net increase of 1.4 million barrels per day, with shutdowns at 900,000 barrels per day. This indicates that overall capacity is not increasing significantly, as many refineries are being repurposed for chemicals or new materials.

Economy

The drop in oil prices earlier this year played a significant role in the decline of inflation during the first half of the year. However, with prices now on the rise, it is anticipated that they will act as a brake on inflation in the second half of this year and into 2024. The European Central Bank recently implemented its 10th consecutive interest rate increase, suggesting that further hikes may not be off the table. Similarly, the US central bank had been expected to have reached its peak interest rate after a decrease in core inflation last month. However, the Federal Reserve has indicated that further increases may be necessary.

This shift in focus to demand and its impact on consuming nations has raised concerns about global financial stability. The Reserve Bank of India has warned that crude oil above $90 a barrel poses a new risk. Analysts predict that Dated Brent could move above $100 a barrel, but if prices rise to $110-$120, the demand for oil products is likely to be significantly impacted.

While higher oil prices can make things more challenging for consumers, they can also indicate positive economic indicators such as increased hiring, higher incomes, and greater consumer confidence. Therefore, it is possible for rising oil prices to coincide with a rising stock market. This scenario remains a possibility going forward.

Market Impacts

Traditionally, it is believed that higher energy costs lead to higher inflation, which in turn leads to higher interest rates, negatively impacting fixed income securities such as bonds. However, research shows that the causal relationship between oil prices and bonds is bidirectional and time-varying. Bonds can go up when oil prices rise or they can fall. While the correlation between oil prices and bonds has mostly been negative since World War I, there have been periods where it has been positive, and there is no reason why the relationship couldn't turn positive again.

The impact of oil prices on equity returns is even more confusing. Higher energy costs would intuitively lead to lower future margins and free cash flows, resulting in lower valuations. While this causal relationship can be observed in certain sectors, such as energy stocks and consumer goods, it is difficult to determine the overall effect of oil prices on stock indices at an aggregate level.

Historical data suggests that higher oil prices do not always spell trouble for the stock market. From 2010 to 2014, oil prices rose from around $70 a barrel to over $100, while the S&P 500 gained roughly 50%. This was due to the fact that higher oil prices often coincide with strengthening consumer demand and a robust economy, which can drive corporate profits higher. During this period, the economy was growing, and consumer confidence increased significantly.

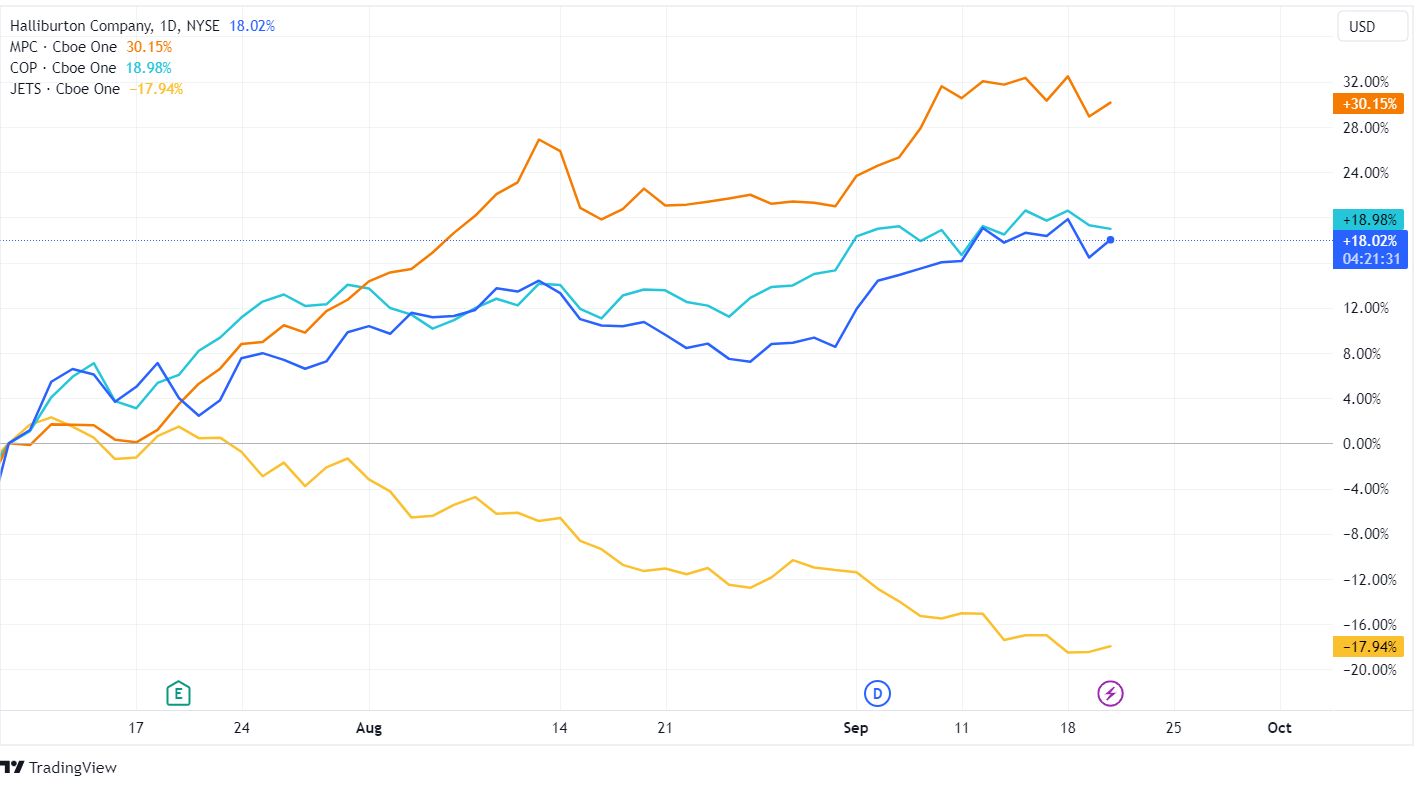

The energy sector has been performing exceptionally well in the stock market, outperforming other segments of the S&P 500. Shares of oil-and-gas companies have seen significant gains, with Halliburton up 25%, Marathon Petroleum up 33%, and ConocoPhillips up 18% this quarter.

Airlines are feeling the pinch from rising fuel costs, with American Airlines, Spirit Airlines, Southwest Airlines, United Airlines, and Alaska Air Group all warning of higher fuel costs for the third quarter. This concern has negatively affected airline stocks, with the U.S. Global Jets exchange-traded fund experiencing a 19% decline since mid-July, while the S&P 500 has remained relatively stable

After Article Market Predictions:

For more analysis on these topics, check out these articles:

The Oil Price Shock Is A Direct Consequence Of Interventionism

US Producer Prices Rise Most in More Than a Year on Energy Costs

World at beginning of end of fossil fuel era, says global energy agency

OPEC Oil Data Show 3 Million-Barrel Shortfall on Saudi Supply Squeeze

Saudi Arabias energy minister says oil cuts not about jacking up prices

A Crunch in Key Corner of Oil Market Leaves Consumers Vulnerable to Heat andWar

Thanks For Reading!

If you find value in this newsletter and want to make sure you don't miss any important updates, you should definitely consider subscribing. By subscribing, you'll be the first to know about new articles and special offers.

If you have any newsletters you wish to see in our lineup, please reach out and let us know. We will continually look to incorporate more sources to our weekly wrap-up.